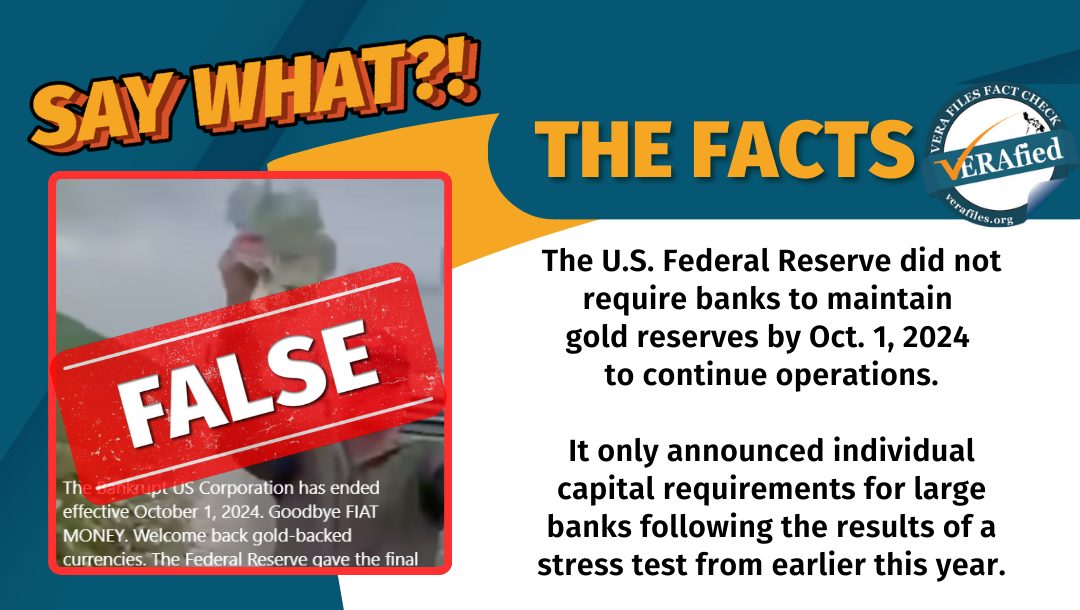

A Facebook (FB) Reel falsely claimed that the United States (U.S.) Federal Reserve is requiring banks around the world to maintain gold reserves to continue operations.

In its Aug. 28 press release, the Federal Reserve only announced final individual capital requirements for large banks (those with US$100 billion or more in assets) effective Oct. 1, following the results of a stress test it conducted this year to evaluate the banks’ financial resilience under recession.

The press release did not imply a return to a gold standard, where a country’s currency is directly linked to a specific quantity of gold.

On Oct. 2, FB page Filipino Future made this claim in its caption:

“The Bankrupt US Corporation has ended effective October 1, 2024. Goodbye FIAT MONEY. Welcome back gold-backed currencies.

The Federal Reserve gave the final deadline of October 1, 2024 to all banks to meet the new requirements per their website. Banks must be Basel III compliant. Meaning, they must have gold reserves to continue the operation.”

Also contrary to the claim, U.S. banks shall begin transitioning to the Basel III standard beginning July 1, 2025, while banks in the European Union shall begin implementing the new framework by Jan. 1 next year.

Basel III, created by the Basel Committee on Banking Supervision, is the third among a series of reforms where banks are required to implement changes in their risk management and increase their capital to withstand financial and economic stress.

The erroneous FB Reel, which generated 372 reactions, 152 comments, and 208 shares, appeared a day after the Federal Reserve’s requirements for large banks’ individual capital requirements took effect.

The video featured in the Reel came from an unrelated Instagram video originally posted by American fitness influencer Demi Bagby on Nov. 20, 2021, which shows U.S. dollars spilling over a highway in Carlsbad, California.