![]() STATEMENT: Independent senatorial candidate Greco Belgica was asked in a television interview on March 15 what his first bill would be if he won a seat in the Senate. He said he would push for a flat tax system on personal income.

STATEMENT: Independent senatorial candidate Greco Belgica was asked in a television interview on March 15 what his first bill would be if he won a seat in the Senate. He said he would push for a flat tax system on personal income.

“Flat rate, meaning if you make P1 million, you pay P100,000. If you make P10,000 you pay P1,000… 10 percent flat rate. Ginagawa na po ‘to sa halos mahigit kalahati (Many are doing this)… China, Russia, the biggest and strongest nations of the world, are flat tax.”

The income tax rate in the country ranges from 5 to 32 percent.

Source: News to Go’s Oplan e-Leksyon: The senatorial interviews (4:20—5:00)

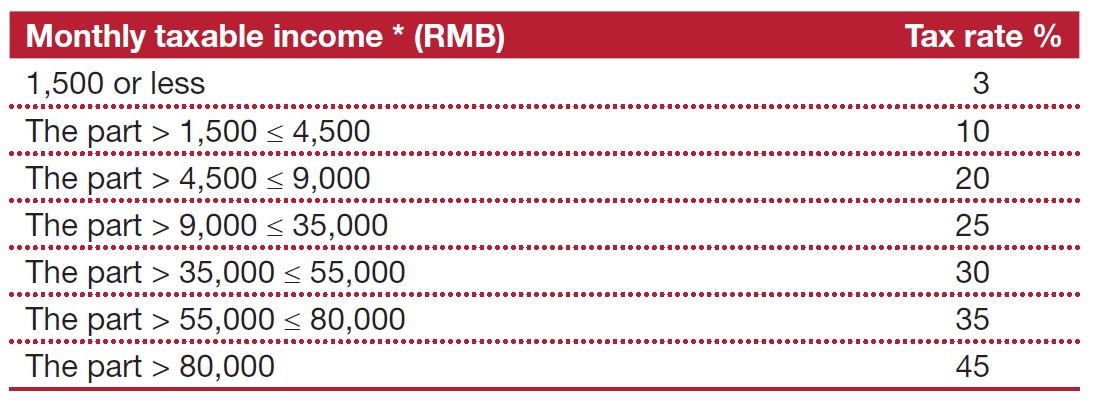

FACT: Russia, indeed, imposes a flat tax rate of 13 percent on personal income. But not China, which practices progressive taxation. Income from wages and salaries, for example, is taxed from 3 to 45 percent.

Source: The People’s Republic of China Tax Facts and Figures—2015

—Mark Kevin Reginio

(The contributor is one of the University of the Philippines journalism majors who are fact-checking candidates for their Journalism Ethics [J110] course taught by VERA Files trustee Yvonne T. Chua.)