By ELLEN TORDESILLAS, AVIGAIL OLARTE, YVONNE CHUA and LUZ RIMBAN

PRESIDENTIAL son Juan Miguel “Mikey” Arroyo failed to declare to the Commission on Elections contributions that he said he received when he ran for Congress in 2004 and 2007.

PRESIDENTIAL son Juan Miguel “Mikey” Arroyo failed to declare to the Commission on Elections contributions that he said he received when he ran for Congress in 2004 and 2007.

Mikey said on national television Tuesday that campaign contributions and wedding gifts were partly the reason his declared net worth ballooned from P5.7 million in 2001 to P74.4 million in 2004 and then to P99.2 million last year. Mikey wed his second cousin Angela Arroyo Montenegro in 2002.

The numbers say Mikey’s net worth grew by more than 1,600 percent in the seven years that he has been a public official. President Gloria Macapagal Arroyo’s eldest son, a one-time movie actor, became vice governor of Pampanga in 2001, and was elected congressman of the province’s second district in 2004 and 2007.

“Siyempre unang una, kinasal tayo. Medyo nagkaroon tayo ng maraming regalo. Tapos pag kampanya, siyempre kahit paano maraming tumutulong sa atin (Of course, first I got married. We received a lot of gifts. Then during campaigns, somehow we get contributions),” Mikey told Solita Monsod and Arnold Clavio, hosts of the morning show “Unang Hirit.”

But his statements of contributions and expenses for the last two congressional elections show zero donations to his campaign, which he reported as having been funded from his own pocket.

Mikey declared campaign expenses of P483,000 in 2004 and P552,876.15 in 2007. His 2007 spending included posters and leaflets, P246,740.10; gas and diesel, P88,332.80; meals, P148,560; rental of building, P40,000; and miscellaneous expenses, specifically financial assistance to indigents, P29,243.25.

The Omnibus Election Code requires candidates to file a “full, true and itemized statement of all contributions and expenditures in connection with the election” within 30 days after the election. This means the candidate is supposed to declare contributions in all forms and amounts made by all donors.

Election law expert Sixto Brillantes said Mikey could have committed perjury for failing to report the campaign contributions he received.

He added, “If he used that (campaign contributions) for personal purposes, then he should report that as an income, as a donation. If he did not report that, then he violated the Income Tax Law.” The Internal Revenue Code imposes a donor’s tax on donations.

Mikey’s appearance on Unang Hirit stemmed from a VERA Files report that said he failed to declare in his Statements of Assets, Liabilities and Network (SALN) for 2007 and 2008 a million-dollar beachfront house in Foster City, California, currently registered in his wife’s name.

VERA Files also reported that Mikey and his brother, Camarines Rep. Diosdado Ignacio “Dato” Arroyo, started buying houses in California and acquiring local business interests soon after they became congressmen.

Mikey said he and his family could well afford to buy houses in California, including the $1.32 million (P63.7 million) property at 1655 Beach Park Blvd in Foster City he bought and transferred to his wife’s name in August 2006.

He also insisted, “(The Foster City house) belongs to a company named Beach Way LLC. I’m not the sole owner. I’m part of the owners. I own about 20 to 30 percent, 40 something, like that…She (my wife) doesn’t own anything.”

The interspousal deed transfer recorded in August 2006 as Document No. 2006-126985 in the San Mateo County Assessor’s Office, however, shows “Juan Miguel Arroyo” granting the house in Foster City to his wife “Angela Arroyo Montenegro.”

Although Mikey listed Beach Way Park LLC in his 2007 and 2008 SALN, the San Mateo County Assessor’s Office has no record of Beach Way Park LLC (Limited Liability Company) owning the Foster City property. There is also no listing of a business entity named Beach Way Park in the county assessor’s office, California Secretary of State and the U.S. Securities and Exchange Commission. The company is also not registered with the Philippine SEC.

Instead, the most recent entry on the Arroyo’s Beach Way Park on the county assessor’s database is Document No. 2008-041550 recorded in April 2008 in which Indy Mac Bank (now OneWest Bank) “reconveyed” or returned the Foster City property to Angela “by reason of the payment of the indebtedness.” She had mortgaged the house for $858,000.

SALN filing guidelines require public officials to declare property owned by their spouses.

Mikey also told Unang Hirit that the Foster City house is not for sale.

VERA Files reported that the property was being sold after confirming that it was—and still is—advertised as for sale on the real estate Websites www.zillow.com and www.ewalk.com. The ewalk Website names the asking price: $1.38 million.

The San Mateo Tax Collector/Treasurer’s Office assessed the value of the Foster City property at $1.35 million in 2008 and $1.37 million this year. Data from this office also show the $14,511.48 property tax was paid last Jan. 16 and payment of the $14,869.62 property tax for 2009 falls due on April 10, 2010.

Mikey said on TV that the “residential house” in the U.S. he declared in his 2005 and 2006 SALNs are two different houses. “We sold the (2005) house after five or six months,” he said, and then bought another house.

Of the U.S. house declared in the 2006 SALN, Mikey said, “Nabenta rin ito (We also sold this). It’s not the Foster City residence.” This means he bought three houses from 2005 to 2006, but did not identify the other property.

Asked by Clavio about reports he had bought another property in the U.S., Mikey said, “Meron, pero hindi sa kin yun (There is, but it’s not mine).” He and Clavio then laughed.

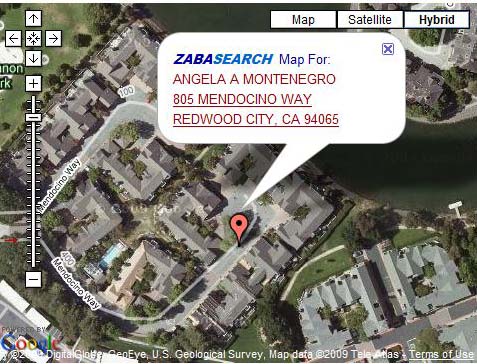

Aside from the house in Foster City, the San Mateo County Assessor’s Office records the Arroyos’ purchase in September 2005 of their three-bedroom unit at the Manors Condominiums at 805 Mendocino Way in Redwood City for $900,000.

Aside from the house in Foster City, the San Mateo County Assessor’s Office records the Arroyos’ purchase in September 2005 of their three-bedroom unit at the Manors Condominiums at 805 Mendocino Way in Redwood City for $900,000.

Like the Foster City house, Mikey had transferred the property to his wife. Angela sold the property in December 2006 for $880,000, four months after they bought the Foster City property.

Former Civil Service Commission Chair Karina David told another television program last week that the transfer of ownership to wives or husbands of properties that may have been acquired illegally has been a practice by government officials who cannot explain their wealth acquisition.

On the sudden increase in his assets, Mikey said, “(It’s not) ill-gotten, hindi naman kalakihan ’yan (It’s not too big).”

Under Republic Act 6758, a vice governor receives a monthly compensation equivalent to salary grade 28, with a pay ranging from P15,180 to P16,275. A congressman receives a basic salary of P35,000 a month or P420,000 a year, according to the Commission on Audit.

In the three years he served as vice governor, Mikey should have earned a gross income of P634,725, including 13th month pay. Despite having declared no real property or business interests while still vice governor, even after his marriage to Angela, save for P2.1 million of unspecified shares of stock in 2001 and 2002 and about P3 million in bank deposits, he managed to acquire by 2004 a house in Lubao, Pampanga, worth P4 million and a house in La Vista in Quezon City for P8 million. He did not report having borrowed money or incurred other liabilities before he was elected congressman. His SALN for 2004, however, shows him declaring his wife’s business interests in five companies since the 1990s.

In his first term as congressman, Mikey’s gross salary should have totaled P1.26 million.

Mikey declared acquisition of businesses in 2006: Mikey’s Horseman Bar and Grill Inc., Visualtoon Creations Inc. and LPG Auto Gas. Shortly after he got elected in 2007, he again declared new business interests: Los Manos Verdes Inc. and Beach Way Park but stopped declaring Visualtoon. In 2008, he declared his investment in U18 Properties Inc. and La Vista Investments and Holdings Inc.

Mikey also first declared in 2005 a “personal loan from relatives” of P27.1 million, an amount he continued to list among his liabilities until July 2007, indicating that the loan went unpaid. In December 2007, his “advances from relatives” climbed to P33.8 million. The same entry and amount appear in his December 2008 declarations.

He lists cash in bank and on bank (P51 million in 2008 and P46 million in 2007), and stock portfolios (P44 million in both years) as his most substantial assets.

Although Mikey said his wealth was not that big, the Foster City house and the Redwood City condo that he and his wife still owned in 2006 had a combined value of $2.22 million or about P108 million, an amount that could have bought 2.16 million textbooks for public school children.

Unable to explain the gaps in his SALN, Mikey said his lawyers “made a mistake” in filing the SALN and the law allows him to correct the errors in his annual declarations. “Hindi pa tayo sanay mag-file ng SAL (We were not yet used to filing SALs),” he said.

David said while the law allows corrections to the SALN, the mistake should not have been repeatedly committed.

“Pero kung taun-taon at mali at kinorek mo, ang question diyan ay hindi iyong ikaw ba ay nagsinungaling lamang kundi pati kung kaya mo bang panindigan na kumita ka ng ganun kalaking halaga para makakuha ng ganyang klase ng kayamanan (If the mistake was committed every year and you corrected it, the question here is not only whether you are lying but also whether you can explain how you were able to acquire that kind of wealth),” she said.

On Unang Hirit, Mikey challenged his detractors, “Why don’t you just sue me in court? Get it over with?”

The SALN Manual says, “The SALN is made under oath. Falsification of information or failure to file or report information required to be reported may subject you to disciplinary/criminal action. Knowing and willful falsification of information required to be reported may also subject you to criminal prosecution.”

Under Republic Act 6713 entitled “Establishing a Code of Conduct and Ethical Standards for Public Officials and Employees,” the penalties for willful falsification of information ranges from imprisonment of five years or less, a fine of P5,000 or less, and dismissal from the service.

David said a government official caught lying in his SALN can be charged with perjury. Lying in the SALN can also be interpreted as having unexplained wealth, which can be a basis for a graft case, she said.