By ELLEN T. TORDESILLAS

I don’t do online purchases for fear that information about my credit card would be mis-used.

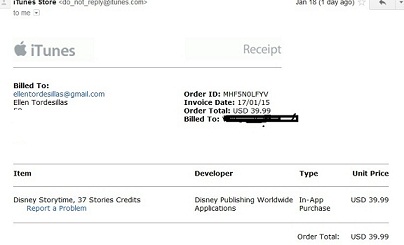

That’s why I was surprised and outraged when I got a notice by email the other night that I was being charged two purchases, $39.99 each totalling $79.98 almost $80.00 or P3,600.00.

The items downloaded were both Disney story time from ITunes.

I don’t do business with I Tunes and definitely not with my credit card.

My BDO visa was hacked!

I reported the fraud to Apple.

I also called up BDO which confirmed the two charges. The customer officer said they will investigate the subject of my complaint and the first step was for me to accomplish the Dispute Form they would be sending me. Meanwhile, they said they would be blocking my account.

They also said they would still be billing me for those fraudulent purchases.

I told the customer officer that I will not pay for those items I did not purchase. I also terminated my account.

I told the customer officer that I will not pay for those items I did not purchase. I also terminated my account.

When you do business with a bank or a credit company, you are assured that your account is secure and they have installed safeguards to protect your account.

BDO did not safeguard my account. I should not be made to pay for their negligence.

I shared my experience with a friend who said her daughter’s friend also has the same misfortune. Her credit card was BPI’s. She was charged 656 Euros (equivalent to almost P34, 000) for a purchase which was impossible for her to have made because she was here in the Philippines.

Used responsibly, a credit card offers a lot of convenience.

One, it allows you to bring small amount of cash and still do important purchases like groceries.

Two, you can buy items on sale or things that you have been looking for when you see them even if you don’t have cash on hand. (During my student days, I would try to save money for books I’d like to buy. But by the time I had the money, the book was no longer available.)

I find credit cards very useful when buying airline tickets in advance.

Three, I get a lot of reward items like SM gift checks for BDO credit cards and appliances for Citibank cards.

But hand-in-hand with the convenience that technology offers are risks posed by malevolent minds. It’s condemnable that some people use their skill and expertise in information technology for devious ends.

If credit card companies cannot safeguard their clients’ accounts, consumers have no other recourse but to go back to pre-credit card days.

It’s inconvenient, yes. But maybe it’s good. We would be spending less.