(Conclusion)

BUSINESS tycoon Manuel Pangilinan offered China’s state-owned oil firm access to the Spratly group of islands in the South China Sea over which the Philippines has a territorial claim, although he had no legal capacity to do so.

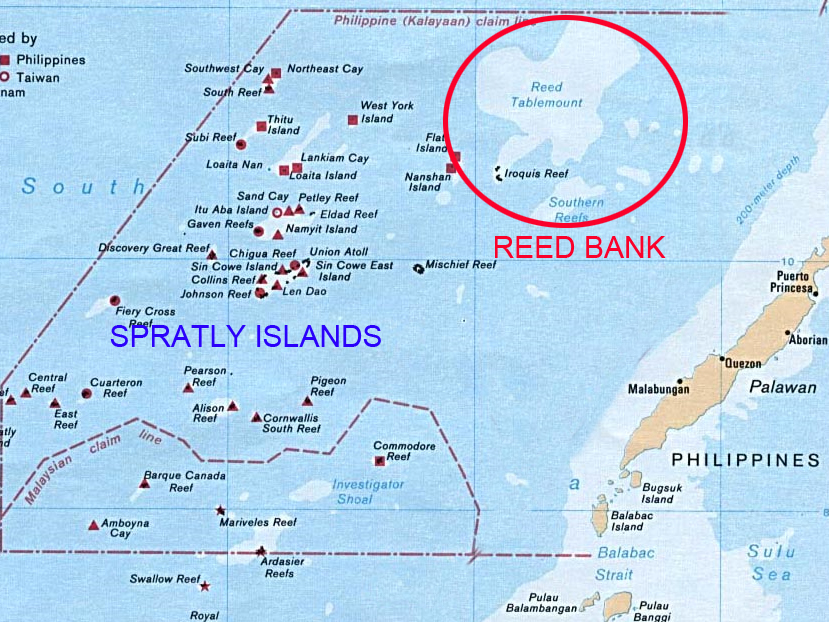

Pangilinan, chairman and chief executive officer of Philex Petroleum Corp, offered to include in his discussions with officials of the state-owned China National Offshore Oil Corp. (CNOOC) the Spratlys Islands, even if his company’s contract with the Philippine government is limited to Reed Bank, which is part of Palawan.

In an aide memoire addressed to President Benigno Aquino dated May 7, 2012, Pangilinan reported on his meeting with CNOOC officials led by its president Yang Hua and listed his 11 point proposal which, he said, the Chinese “received positively.”

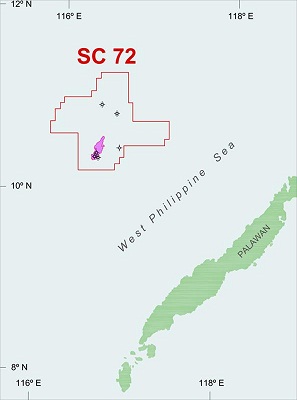

The 11-point proposal includes a Framework Agreement between Philex and CNOOC “relating to an area of mutual interest which will be defined as the area covered by SC 72.”

“Other disputed areas (such as the Spratlys) could be included by agreement,” wrote Pangilinan.

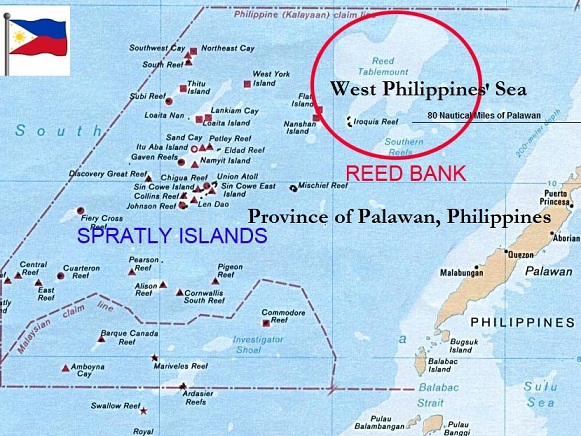

SC 72 refers to Service Contract 72, signed in 2010, in which the Philippine government awarded Forum Energy Plc. (FEP) exploration rights to a basin within Reed Bank. Philex owns 64.45 percent of FEP, a London-based listed oil and gas exploration firm focused on the Philippines. FEP in turn owns 70 percent of SC 72.

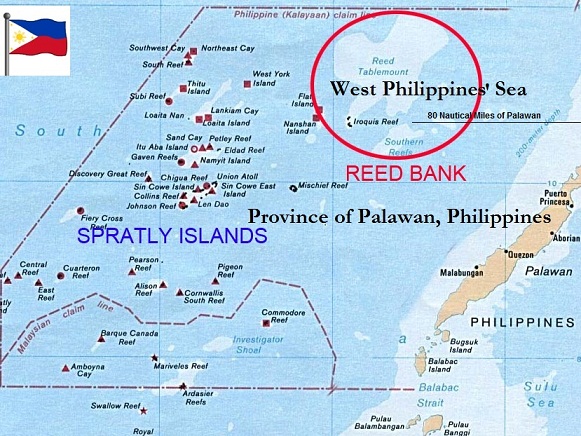

Reed Bank is not in the Spratlys, although China is claiming it as part of its territory under its 9-dash line map in which covers almost the entire South China Sea. Aside from the Philippines and China, Vietnam and Taiwan also claim Reed Bank.

SC 72 is a seven-year exploration contract that can be extended y three years. Its 25-year production period can be extended by another 15 years.

The Spratlys is being claimed either wholly or partially by the Philippines, China, Brunei, Malaysia, Vietnam and Taiwan.

Pangilinan said, “The period of the Framework Agreement will be from execution up to the date on which the parties reach a determination as to whether hydrocarbon resources in the area of mutual interest are capable of commercial development.”

“The Framework Agreement will cover exclusively commercial and technical arrangements and neither party will take a position on the sovereignty issue which is agreed to be a Government to Government matter,” wrote Pangilinan, who is also managing director of First Pacific Co. Ltd., whose chairman is the Indonesian tycoon Anthoni Salim.

Philex president and FEP executive director Carlo Pablo said neither the Philippines nor China has approved the proposed framework agreement at this time. There is also “nothing agreed yet” on CNOOC’s specific participation in SC 72, he added, nor is there any agreement on the offer to include the other disputed areas, including Spratly Islands.

“The framework agreement will set out an exploration work program to be implemented in stages designed to determine by year 2016 the commerciality of hydrocarbon resources in the area of mutual interest,” the Pangilinan memoire said.

Pangilinan said, “Philex will give CNOOC an opportunity to make an equity investment in Forum Energy Plc under terms to be agreed.”

Legal experts warn that Pangilinan’s offer to CNOOC would violate the Philippine Constitution which states that “the exploration, development, and utilization of natural resources shall be under the full control and supervision of the State.”

The Constitution further provides that “the state may directly undertake such activities or it may enter into co-production, joint venture, or production-sharing agreements with Filipino citizens, or corporations or associations at least sixty per centum of whose capital is owned by such citizens.”

A Joint Marine Seismic Undertaking by the Philippines, China and Vietnam in disputed areas, including Reed Bank, that was entered into by President Gloria Arroyo in 2004 has been questioned in the Supreme Court on the basis of these charter provisions.

Pangilinan’s proposal to CNOOC also states that a separate agreement would be negotiated by the parties if oil and gas of commercial quantity is discovered in the area, including the terms for profit-sharing.

“Any subsequent agreement (including any agreement as to the sharing of any profits after deduction of appropriate capital and operational expenses) between CNOOC and Philex to develop hydrocarbon resource within the area of mutual interest would be conditional on a resolution by the Philippine and Chinese Governments of the dispute relating to the sovereignty of such area,” Pangilinan said in his aide memoire.

Pangilinan clarified that the two parties would agree on their respective roles, “including the terms on which CNOOC might participate in the exploration work program as a technical consultant, and/or advisor, and/or investor.”

The two firms opted to form a working group that would negotiate and implement the framework agreement subject to approval of their governments. Each party would have two members in the group.

Representatives of the two companies also decided to exchange technical information on SC 72 but again subject to approval of their governments and other possible joint venture partners. The work program would also have to be approved by their respective authorities.

As an additional point, Pangilinan said he would later propose that the framework agreement be subject to “a neutral but internationally-recognized jurisdiction,” preferably British law, as long as this does not go against Philippine laws and the terms of Philex’s contract with the government under SC 72.

Pangilinan was accompanied in the Beijing meeting by Pablo, First Pacific executive director Robert Nicholson, and Pangilinan’s executive assistant Edilbert T. Dungo.

Also sitting on the CNOOC side were the general manager of CNOOC’s legal department Kang Xin, the deputy general manager of the foreign affairs bureau Zhi Yiran, the deputy general of the exploration department Cai Dongsheng, overseas exploration director Cui Hanyun, and director for neighboring affairs Zhang Sheng.

The government has extended until August 2015 the deadline for completing the first phase of FEP’s work program involving an $80 million investment, after it failed to issue a permit for the survey needed before the company can start drilling.

“We are still awaiting Government instructions,” Pablo replied when asked if FEP has been given the go signal to resume exploration.

The decision to grant permits concerning the exploration and drilling activities in Reed Bank should come from Foreign Secretary Albert del Rosario, who is himself a former director of Philex and a close associate of Pangilinan. The Department of Energy deferred to Del Rosario’s office this authority last year because of its foreign relations implications.

The Philippines has asked the UN Arbitral Tribunal to declare as invalid China’s 9-dash line that covers almost 90 per cent of the whole South China Sea and to declare as part of the Philippine 200 nautical mile the continental shelf rocks, reefs and shoals that are exposed at low tide but submerged at high tide where China has built structures.

The UN tribunal is expected to rule on the Philippine suit, which has been snubbed by China, before the end of the Aquino administration in 2016.

Supreme Court Justice Antonio T. Carpio said a favorable decision by UN Arbitral Tribunal will clarify the situation in Reed Bank.

“There can no longer be any legal dispute that the fully submerged Reed Bank, which is where the rich reserves of gas is located, belongs exclusively to the Philippines, being within 200 nautical miles from Palawan and more than 800 nautical miles from China. The resolution of the legal issue is important for investors,” Carpio said.