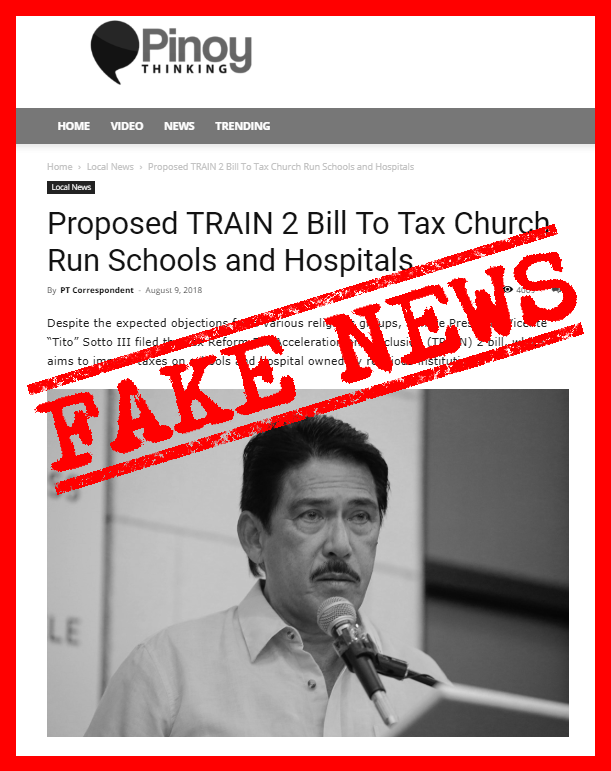

No, church-run institutions will not be taxed in the proposed second tax reform program under the Duterte administration.

Website pinoythinking.net published this piece of fake news Aug. 9, claiming that the tax exemption for schools and hospitals run by religious institutions will be lifted under Senate Bill 1906, filed by Senate President Vicente “Tito” Sotto III.

SB 1906, or the Corporate Income Tax and Incentives Reform Bill, carries no such provision.

Finance Undersecretary Karl Chua also denied the claim the same day pinoythinking.net’s fake story was published.

“Religious institutions remain exempt while non religious for profit will be subjected to performance- based tax incentive,” Chua said in a text message to the Manila Bulletin.

Article VI, Section 28 (3) of the 1987 Constitution exempts from taxation non-profit church-run institutions “actually, directly, and exclusively used for religious, charitable, or educational purposes.”

The fake story, which could have reached over 5.9 million people, was published a few days after Sotto filed the bill Aug. 2. On Aug. 7, the counterpart House Bill 7982 passed committee deliberations.

Social media traffic to the story largely came from the pages Pinoy Thinking, Duterte Kami and Rodrigo Duterte 16th President.

Pinoythinking.net was created March 3.

(Editor’s Note: VERA Files has partnered with Facebook to fight the spread of disinformation. Find out more about this partnership and our methodology.)