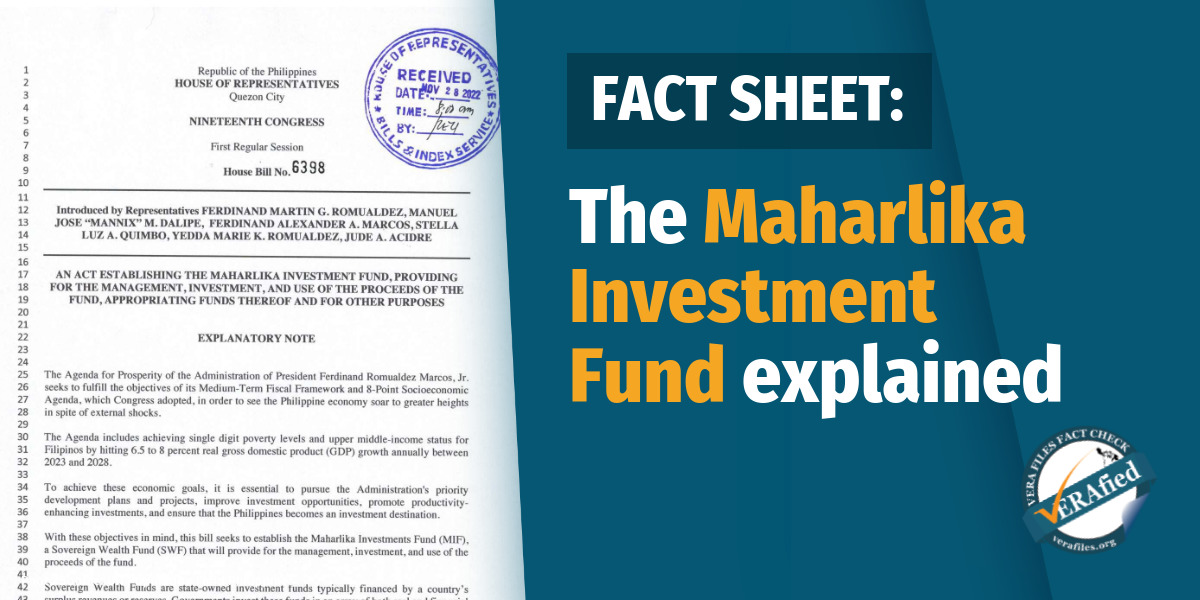

For the majority of us who are neither into actuarial science nor economics, we can learn from the many countries that have invested on a sovereign wealth fund. By doing so, it is possible to come up with an informed judgment on the proposed Maharlika Wealth Fund of the Marcos-Romualdez representatives in Congress.

All definitions of a sovereign wealth fund are in agreement, that it is a state-owned investment fund comprised of money generated by the government, often derived from a country’s surplus reserves. That second phrase is an important operative because practically all sovereign wealth funds come from a state’s savings or surplus money.

The journalist Ed Lingao simplified it in very understandable layman’s terms in his television news program on TV5 to give us a fairly comparative basis where the Philippines stands.

About seventy nations of the world have sovereign wealth funds. Among the biggest are France ($1.5T), Norway ($1.2T), China ($1.2T), United Arab Emirates ($708B), and Kuwait ($708B). One glance at these countries already gives us a common sense of where we are.

Money in a sovereign wealth fund is invested in stock markets, bonds, real estate, precious metals, hedge funds, etc. These countries have budgetary surpluses. We do not have that. As a matter of fact, we even source of part of our annual appropriations budget from foreign loans. Haven’t we forgotten: the Department of Finance has recently announced (August 26, 2022), that we will borrow P1.16T to cover the projected budget deficit in 2023.

Why is that? In simple terms, this is our situation: the proposed budget is P5.268T but our total revenue projection is only at P3.6T. What we have is a deficit, the exact opposite of surplus. On the first basis for a sovereign wealth fund – surplus – sorry folks but we obviously do not qualify.

These big league countries have another advantage: they have low or no foreign debts. That one we have loads of. The hard data is that by the end of 2023, our outstanding debt will rise to a record high of P14.63T. Debt payments alone will rise to P1.16T by next year, the first full year of the Marcos Jr. administration. The previous Duterte administration ended with P11.73T in both domestic and foreign debt.

For validation, here’s what the Bureau of the Treasury says about our debt status, that by end September 2022, our national government debt is already at a staggering P13.52T. In terms of having a low or no debt at all – kelangan pa bang i-memorize yarn – we absolutely do not qualify.

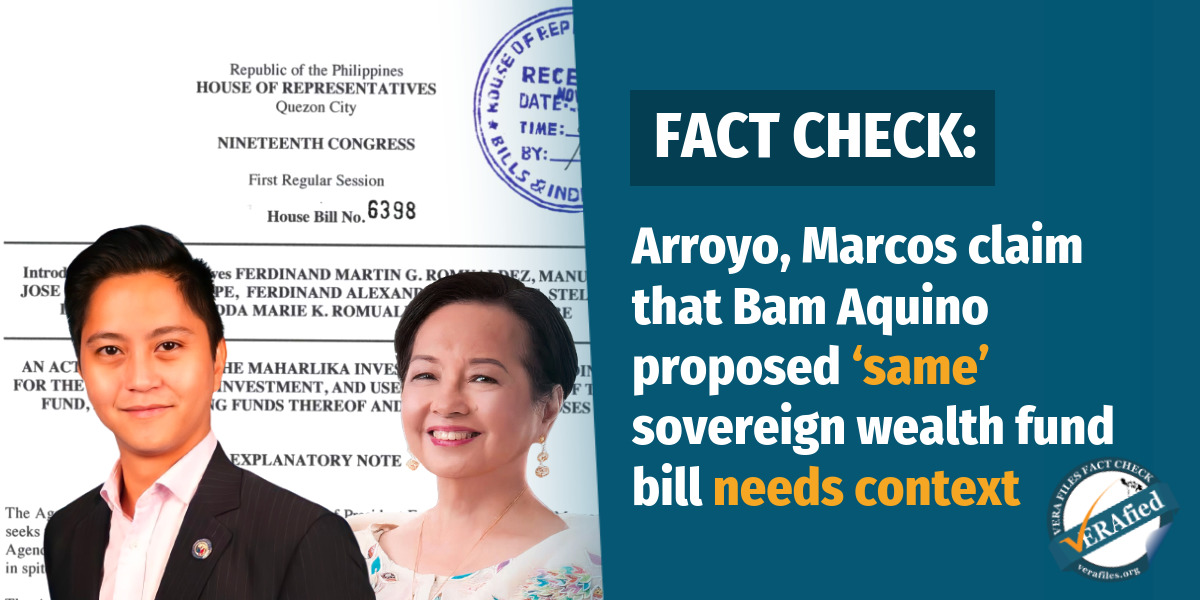

If there is a raging public outcry because of the inclusion of money from pension agencies Social Security System and the Government Service Insurance System, wait till the uproar comes from our Overseas Filipino Workers. Currently numbering at 745,000 (2021 data yet), 10% of their remittances will go to the Maharlika fund. House Bill 6398 of Speaker Martin Romualdez, his wife Yedda Marie Romualdez, and the president’s son Sandro Marcos is unclear as to the mechanism of how the OFW’s 10% will be infused into the fund. Definitely that could be another source of public furor.

If anything, the three congressional cousins are starting from the wrong foot. The No. 1 problem is public distrust. It is not coincidence that all three come from families with solid evidence on acquiring ill-gotten wealth during the Ferdinand Marcos Sr. dictatorship. It is on record, attested to by even Supreme Court jurisprudence, that the Marcoses have not returned their ill-gotten wealth. The president himself has evaded paying taxes to the tune of P203B – an amount that by itself is almost sufficient to cover the projected P250B Maharlika Wealth Fund.

To begin with, why the fixation for the name Maharlika? Its best association is the fake World War II guerilla group of the dictator that even the US Army and US Veterans have refused war claims because it was proven to be – take note of the adjectives used – “distorted, exaggerated, fraudulent, contradictory and absurd.”

The neophyte but deputy majority floor leader Sandro is not helping quell the criticisms by saying the issue is being politicized. He has forgotten his own examination of conscience that his family does not have an immaculate record of managing public money. That three cousins of the brand Plunder have spearheaded the bill is the first instance of politicizing the issue.

Under the House Bill, his father will chair the sovereign wealth fund. Let’s use a cliché because it is spot on: Dracula will be appointed to manage the blood bank.

The views in this column are those of the author and do not necessarily reflect the views of VERA Files.