Bangko Sentral Governor Felipe Medalla, who initially voiced reservations over the proposed Maharlika Investment Fund (MIF) bill, has joined other economic managers in pushing its legislation, saying it is a “tried and tested” investment vehicle for growth. This needs context.

The economic managers led by Finance Secretary Benjamin Diokno released a joint statement on Friday, Dec. 9, after the House committee on appropriations changed contentious provisions following public backlash on the proposed use of pension funds from the Social Security System (SSS) and the Government Service Insurance System (GSIS) to bankroll the MIF.

(Read VERA FILES FACT SHEET: The Maharlika Investment Fund explained)

STATEMENT

Apart from Diokno and Medalla, the joint statement endorsing the enactment of the MIF bill was also signed by Budget Secretary Amenah Pangandaman and Socioeconomic Planning Secretary Arsenio Balisacan. It said:

“We, the Economic Managers of the Marcos Jr. Administration, strongly support the creation of the Maharlika Wealth Fund as a vehicle to move forward the Agenda for Prosperity and achieve the economic goals of the administration.

The establishment of a Sovereign Wealth Fund is a tried and tested investment vehicle that has been used by governments in both first world and developing countries to achieve their economic objectives.”

Source: Department of Budget and Management official website, Statement of Economic Managers on the Creation of the Maharlika Wealth Fund, Dec. 9, 2022

The economic managers cited Indonesia’s Investment Authority and Singapore’s GIC and state investor Temasek as “successful models” of a sovereign wealth fund that have contributed to their respective national budgets. They said:

“We have confidence that with professionals managing the funds, there will be efficient use and management of these investible public funds. They will be able to ensure the availability of an alternative high return investment platform, obtain the best absolute return for the funds, find additional sources of liquidity as the need arises, and perform better risk management, given additional layers of checks and balances in the use of investible funds.”

FACT

While Medalla did not categorically oppose the creation of the MIF, he raised concerns over some of its provisions.

Interviewed on Bloomberg TV on Dec. 2, Medalla expressed reservations over the MIF, raising the issue of governance and the fund’s potential impact on the dollar reserves of the Bangko Sentral ng Pilipinas (BSP).

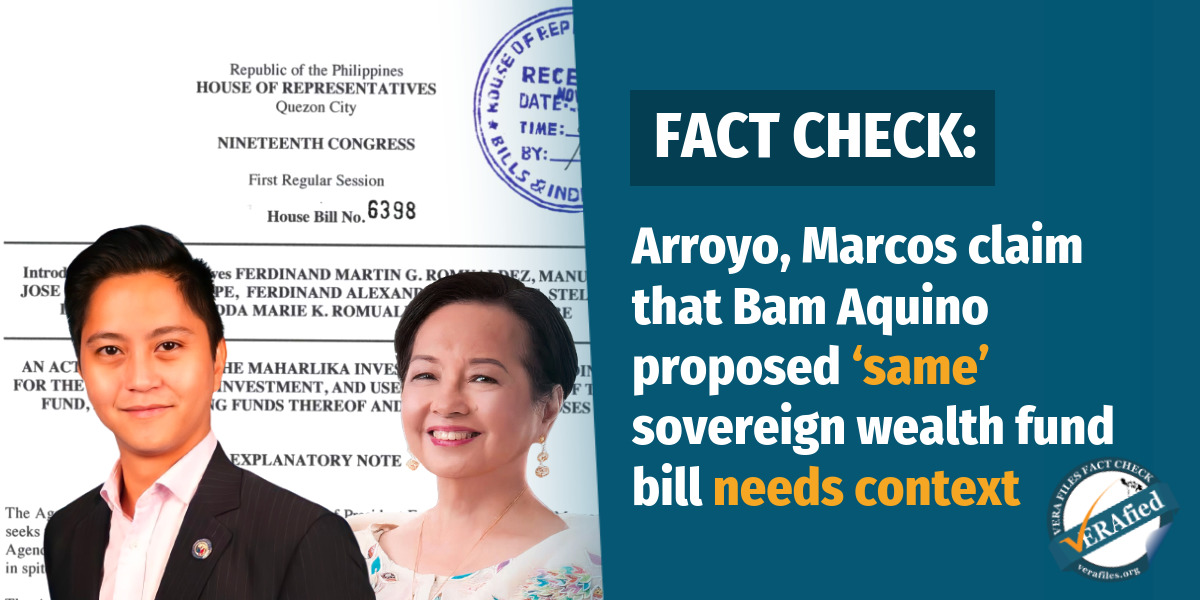

On Monday, Dec. 12, the House committees on banks and financial intermediaries, appropriations, and ways and means came out with House Bill No. 6608 in place of HB 6398 filed by Speaker Martin Romualdez and five other House leaders on Nov. 28. The substitute bill incorporates the changes on contentious provisions that Medalla raised concerns on such as funding sources, chairmanship and the number of independent members of the board.

On the issue of governance, he said: “To me, the experience of 1MDB Malaysia is the biggest risk, right? Even if the current guys are okay, will the guys, five years from now, [s]till be okay?”

In 2009, then prime minister Najib Razak of Malaysia set up 1MDB to promote economic development. It later turned into a multi-billion dollar scandal involving several financial institutions and high-ranking officials worldwide.

Razak, who led 1MDB’s advisory board, was convicted of corruption, breach of trust, and money laundering for depositing $9.8 million from a former unit of the fund to his personal bank account. He remains on trial for at least four other charges.

On the issue of BSP’s independence, Medalla said: “[T]hey will say it will take the central bank’s dollars then what will we use now [i]f the reserves are reduced because they’ve been taken to the sovereign wealth fund?”

He cautioned that the country may have “less ammunition” when faced with another “international volatility that is related to the peso and the dollar.”

But when asked if the BSP would be willing to invest some of its foreign reserves into the fund, the governor said: “Unless we are compelled, we should not. But I am a law-abiding person. If the law says we will, we will.”

BACKSTORY

Marikina City Rep. Stella Quimbo, vice chairperson of the House committee on appropriations, said the seed money for the MIF will no longer be drawn from the state-run pension funds but from state-run banks, including earnings from the BSP. In the “refined” version of the bill, the Finance secretary will chair the board of governors, instead of the president, and will be joined by four independent directors instead of just two as initially proposed.

Have you seen any dubious claims, photos, memes, or online posts that you want us to verify? Fill out this reader request form.

Sources

House of Representatives, House Bill No. 6398

Department of Budget and Management, Statement of Economic Managers on the Creation of the Maharlika Wealth Fund, Dec. 9, 2022

Yahoo! Finance, BSP Board Split Between 25, 50 BPS for December: Medalla, Dec. 2, 2022

News5 Frontline Pilipinas, BSP Governor Medalla, may alinlangan sa Maharlika Investment Fund Bill, Dec. 5, 2022

House of Representatives, Committee Report No. 237, Dec. 12, 2022

On the 1MDB scandal

- Al Jazeera, Timeline: How Malaysia’s 1MDB financial scandal unfolded, July 28, 2020

- Reuters, Explainer: How Malaysia is seeking to recover billions of dollars missing from 1MDB, May 11, 2021

- South China Morning Post, Rohana Rozhan, Tim Leissner, Rosmah Mansor: all you need to know about the people mentioned in Roger Ng’s 1MDB trial, April 17, 2022

- BBC News, 1MDB: Trial of ex-Goldman banker paused after documents blunder, Feb. 24, 2022

- The Washington Post, How Malaysia’s 1MDB Scandal Shook the Financial World, Aug. 24, 2022

- South China Morning Post, Former Malaysian PM Najib’s 12-year corruption conviction upheld over 1MDB scandal, Aug. 23, 2022

- Malay Mail, 1MDB trial cannot go on today, as Najib and lawyers from both sides still at Federal Court, Dec. 7, 2022

- Yahoo! News Malaysia, 1MDB trial cannot go on today, as Najib and lawyers from both sides still at Federal Court, Dec. 7, 2022

- Malaysia Now, Najib loses appeal for documents linked to Zeti’s family for 1MDB trial | MalaysiaNow, Dec. 8, 2022

- Reuters, Explainer: Malaysia’s ex-PM Najib and the multi-billion dollar 1MDB scandal, Aug. 23, 2022

On refinements to HB 6398

- GMA News Online, GSIS, SSS dropped as mandatory sources of capital for Maharlika Fund, Dec. 7, 2022

- Bloomberg, Philippines Eyes Central Bank Profits as Wealth Fund Source, Dec. 8, 2022

- Inquirer.net, Lawmakers eyeing more changes in Maharlika plan, Dec. 9, 2022

- CNN Philippines, Lawmakers to ditch PH president as chairman of proposed Maharlika fund board, Dec. 9, 2022

- GMA News Online, House to remove PH president as chairman of the board of proposed Maharlika Wealth Fund, Dec. 9, 2022

- PhilStar.com, What’s inside the ‘refined’ Maharlika Wealth Fund bill?, Dec. 9, 2022

(Guided by the code of principles of the International Fact-Checking Network at Poynter, VERA Files tracks the false claims, flip-flops, misleading statements of public officials and figures, and debunks them with factual evidence. Find out more about this initiative and our methodology.)