The authors of the controversial Maharlika Investment Fund (MIF) bill in the House of Representatives dropped the two pension funds – the Social Security System (SSS) and the Government Service Insurance System (GSIS) – as primary funding sources in response to a mounting outcry from various sectors and individuals, including administration allies.

Filed by Speaker Martin Romualdez on Nov. 28, the bill was approved by the committee on banks and financial intermediaries on Dec. 1. It still has to hurdle the ways and means and the appropriations committees before it goes to the plenary for second and third readings.

One of its authors, Majority Leader Manuel Dalipe, said the House aims to approve the bill on second reading before Congress adjourns on Dec. 16.

As public debate over the MIF rages, here’s what you need to know on the issue:

1. What is the MIF?

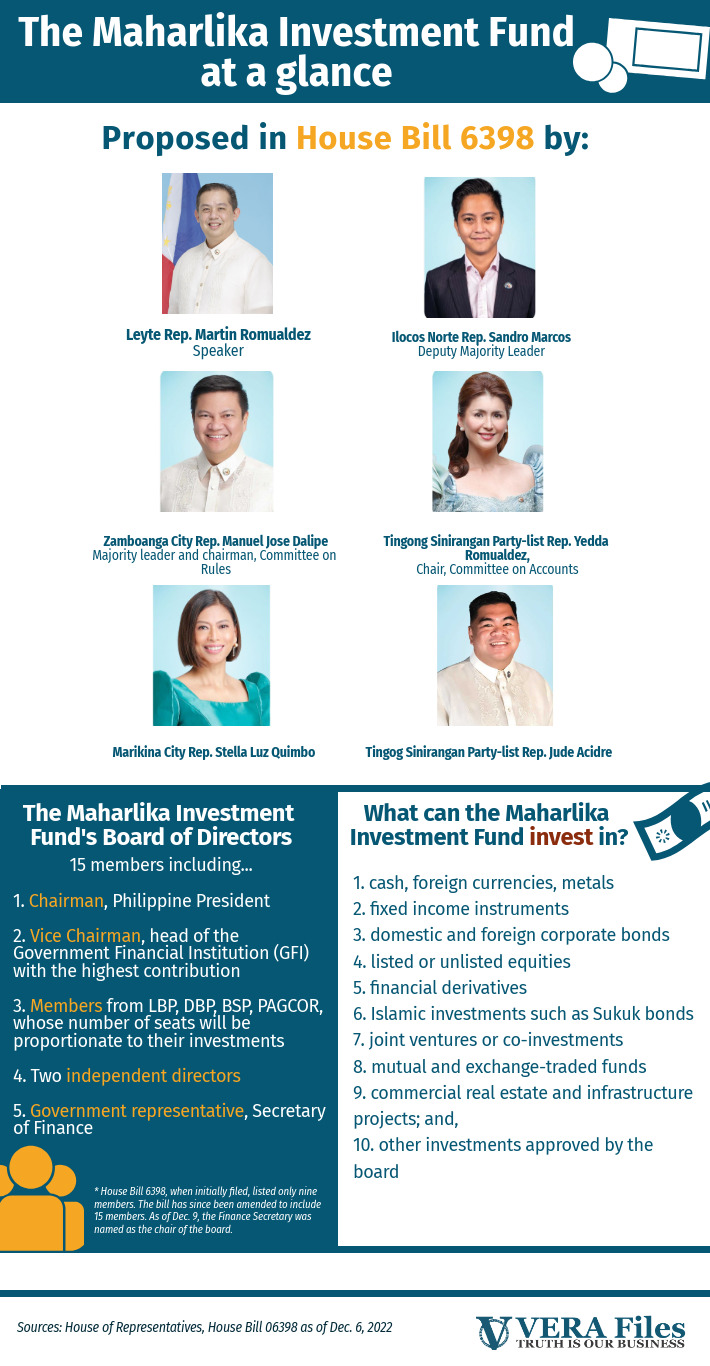

Among the six proponents of the MIF, three are closely related to President Ferdinand Marcos Jr. and occupy powerful and influential positions in Congress. Speaker Martin Romualdez is a first cousin of the president and is joined by his wife, Yedda Marie, as the bill’s principal sponsors, along with the president’s eldest son, Ilocos Norte Rep. Ferdinand Alexander “Sandro” Marcos.

Section 9 of HB 6398 initially identified GSIS and the SSS and two other government financial institutions (GFIs), including the Land Bank of the Philippines, and the national budget as primary sources of funds of the MIF.

This is not the first time a bill proposing a sovereign welfare fund (SWF) was introduced in Congress. In 2016, former senator Paulo Benigno “Bam” Aquino IV sought the establishment of a Philippine Investment Fund Corporation (PIFC).

The global organization Sovereign Wealth Fund Institute (SWFI) defines SWF as an investment fund or entity owned by the state. Its initial investment often comes from a country’s surplus funds, extra foreign reserves, proceeds from privatization and revenue from resource exports such as mining and oil.

HB 6398 similarly defines SWF as “state-owned investment funds typically financed by a country’s surplus revenues or reserves.”

2. Why is the MIF facing so much backlash?

While Finance Secretary Benjamin Diokno had voiced his support for MIF, several economists and legal experts have raised their concerns on several provisions of the bill, including the sources of its initial investment.

As first proposed, the MIF was to take P125 billion from GSIS and P50 billion from SSS. While GSIS can invest funds which are not needed to meet its obligations to contributors, the GSIS Law specifies the types of safer investments the agency can make. The proposed MIF, however, is allowed to invest in riskier assets and more opaque transactions.

“You will notice that it (Article 4, Section 2 of HB 6398) mentions financial derivatives. Now, that’s a high-risk investment, merong chance na malugi ka talaga diyan (There’s a real chance you’ll lose money from these),” lawyer Jan Fredrick Cruz, a lecturer in law, economics, and public policy at the Ateneo de Manila University, said in an interview with VERA Files Fact Check.

A financial derivative is a security or a tradable asset whose value depends on the value of another asset.

After facing a heavy backlash, Marikina City Rep. Stella Quimbo said on Dec. 7 that the Committee on Appropriations will remove the SSS and GSIS as funding sources for the MIF.

Aside from financial derivatives, HB 6398 allows the MIF to invest in alternative investments such as unlisted equities, shares from a company that are not registered in the stock market.

“These assets are highly illiquid, meaning, it’s not easy to turn them into cash. Some of these investments are not listed in the Philippine Stock Exchange. They’re privately traded. So, in other words, the transaction can be quite opaque,” Cruz explained.

Since the fund’s purpose, according to the bill, is to “promote economic growth and social development,” Cruz said that any transaction or investment can easily be justified through these.

“As much as we all want economic development… it sort of authorizes the managers of the sovereign wealth fund to engage in any financial investment because they can always argue that this directly or indirectly contributes to economic growth,” he noted.

Although the authors of HB 6398 insist that transparency mechanisms are in place under the proposed law, the MIF’s exception to laws, such as the Government Procurement Reform Act or Republic Act 9184, raises red flags. The exemption from RA 9184 means that the MIF’s contracts will not be scrutinized by the Office of the Government Corporate Counsel.

In Article 10 Section 35 of HB 6398, the MIF’s records can be accessed only with the approval of its Board of Directors, which the president will chair. For an SWF to be effective, Cruz said a fund’s management should be free from political influence.

“I don’t think that is a situation where you have arm’s length from the political branches of government because you have a politician as chairperson,” he pointed out.

The House Committee on Appropriations revised the bill on Dec. 9 to make the secretary of finance the chair of the Board of Directors.

Critics also question the timing of the MIF proposal as inflation hit 8% in November. At the same time, the country is experiencing a dollar deficit, where the government has lower U.S. dollars in its reserves than it needs for international trade. This happens when a country is paying more for its imports.

Cruz emphasized the importance of using surplus funds for a SWF. “Pwede kang manalo, pwede kang matalo sa investments (You can win or lose in investments), and if malugi ka, mawawala ang pera mo (and if you lose, then you lose money). And that’s why you take advantage of the surplus because you’re able to cover what needs to be spent for while having excess money to invest,” he said.

3. How do other countries manage their sovereign wealth fund?

Norway established its SWF after discovering oil in the North Sea in 1969. Hoping to protect future generations from the volatility of the oil market, Norway created the Government Pension Fund Global in 1996.

Norway’s fund currently has holdings in approximately 9,000 companies internationally and invests in real estate in leading cities. The fund is only invested abroad and is currently worth more than 12 trillion Norwegian kroner (approximately P72 trillion).

To ensure the longevity of the fund, the Norwegian government spends only the expected return of the fund. “In this way, oil revenue is phased only gradually into the economy. At the same time, only the return on the fund is spent, and not the fund’s capital,” according to the Norges Bank Investment Management’s website.

Cruz also mentioned Kiribati’s Revenue Equalization Reserve Fund (RERF). The state established its SWF with proceeds from guano, a fertilizer made from accumulated excrement of seabirds. Although Kiribati’s reserves were depleted in 1979, the country continues to reap the benefits of the RERF. The Asian Development Bank noted that the RERF cushioned Kiribati’s economy from the economic downturn brought by the COVID-19 pandemic.

On the other hand, 1Malaysia Development Berhad (1MDB) was created in 2009 and was a part of former Malaysian prime minister Najib Razak’s plan to alleviate poverty. However, after 1MDB missed a loan payment worth $550 million in 2015, Razak was accused of pocketing nearly $700 million from 1MDB. He was found guilty of transferring $9.8 million to his personal bank account on Aug. 23.

*Cruz said his views expressed in the interview do not reflect those of his affiliations.

Have you seen any dubious claims, photos, memes, or online posts that you want us to verify? Fill out this reader request form.

Sources

House of Representatives, HB 06398, Nov. 28, 2022

GMA News Online, Maharlika Fund bill co-author eyes House 2nd reading nod before Christmas break, Dec. 7, 2022

Inquirer.net, Maharlika Investment Fund may be tackled in 2nd reading within December — Dalipe, Dec. 7, 2022

Manila Bulletin, Proposed ‘Maharlika’ fund OK’d by House panel, given final name, Dec. 1, 2022

Foundation for Economic Freedom Official Facebook Page, JOINT STATEMENT | The Proposed Sovereign Wealth Fund: A Statement of Concern, Dec. 5, 2022

Inquirer.net, Economists, business groups oppose Maharlika Wealth Fund bill, Dec. 5, 2022

ABS-CBN News, Gov’t must first clarify purpose of Maharlika fund: economist, Dec. 7, 2022

Interview with Atty. Jan Fredrick Cruz, Dec. 7, 2022

Senate of the Philippines, S.B. 1212 (17th Congress), Oct. 19, 2016

Sovereign Wealth Fund Institute, What is a Sovereign Wealth Fund?, accessed on Dec. 7, 2022

Government Service Insurance System, Republic Act No. 8291, accessed on Dec. 5, 2022

International Monetary Fund, Financial Derivatives, accessed on Dec. 8, 2022

Inquirer.net, Proposed Maharlika Fund would no longer include SSS, GSIS funds — Quimbo, Dec. 7, 2022

CNN Philippines, Lawmakers to remove SSS, GSIS as funding sources in Maharlika Wealth Fund bill, Dec. 7, 2022

GMA News, GSIS, SSS dropped as mandatory sources of capital for Maharlika Fund, Dec. 7, 2022

Government Procurement Policy Board, Handbook on Philippine Government Procurement, accessed on Dec. 8, 2022

Philippine Statistics Authority, Summary Inflation Report Consumer Price Index (2018=100): November 2022, Dec. 6, 2022

Bangko Sentral ng Pilipinas, INTERNATIONAL RESERVES AND FOREIGN CURRENCY LIQUIDITY, Oct. 31, 2022

Investopedia, Dollar shortage, accessed on Dec. 8, 2022

Norges Bank Investment Management, About the fund, accessed on Dec. 6, 2022

United States Department of State, Kiribati, accessed on Dec. 7, 2022

Asian Development Bank, Asian Development Bank and Kiribati: Fact Sheet, April 2022

The Guardian, Malaysian taskforce investigates allegations $700m paid to PM Najib, July 6, 2015

Al Jazeera, Timeline: How Malaysia’s 1MDB financial scandal unfolded, July 28, 2020

Wall Street Journal, FBI Probes Malaysia Development Fund, Sept. 19, 2015

Bloomberg, Ex-PM Najib Heads to Malaysia Jail After Exhausting 1MDB Appeals, Aug. 23, 2022

BBC News, Najib Razak: Malaysia’s ex-PM starts jail term after final appeal fails, Aug. 23, 2022

The New York Times, Hermès Bags and Millions in Cash: The Fall of Malaysia’s Najib Razak, Sept. 14, 2022

(Guided by the code of principles of the International Fact-Checking Network at Poynter, VERA Files tracks the false claims, flip-flops, misleading statements of public officials and figures, and debunks them with factual evidence. Find out more about this initiative and our methodology.)