INVESTIGATORS of the Anti-Money Laundering Council recently concluded that bank accounts of Sen. Ramon Revilla Jr. and his family, as well as those of Janet Lim-Napoles and her pseudo-NGOs, were possibly involved in a scheme to launder the controversial “pork barrel” funds.

The AMLC’s 64-page inquiry report containing the initial findings is in itself an interesting study of the methods this government agency uses to ascertain that proceeds of an unlawful activity such as plunder were transacted to make them appear to have come from legitimate sources.

The Office of the Ombudsman submitted the report to the Sandiganbayan on Oct. 9 to oppose Revilla’s petition for bail in the plunder and graft and corruption case filed against him; his chief of staff, Richard Cambe, Napoles; her son Ronald John; and her driver-bodyguard, John Raymund de Asis.

Revilla was said to have gotten P224.5 million in “commissions and rebates” from 2006 to 2010 from his Priority Development Assistance Fund projects that were awarded to five Napoles NGOs. The commissions and rebates were reportedly coursed through Cambe.

In probing Revilla’s PDAF, the AMLC applied the “deposit and withdrawal analysis,” “tracing of funds” method, and “multiple account analysis” to a range of documents, from the Commission on Audit special audit report, “JLN CASH/CHECK DISBURSEMENT” (JCCD) vouchers, the joint sworn statement of Benhur Luy and five other whistleblowers, and Luy’s ledger and matrices of cash rebates to Revilla and Cambe, to corporate records of Napoles’ NGOs and a firm incorporated by Revilla’s wife Lani Mercado, and Revilla’s and the NGOs’ bank records.

Leigh Vhon Santos, one of four AMLC bank officers who investigated the case, told the Sandiganbayan that the banks furnished investigators account opening forms, statement of accounts (SOA), deposit slips, withdrawal, slips, credit memos, among others. He took the witness stand on Oct. 9 and Oct. 16.

The banks include Land Bank, Metrobank, Banco de Oro, Asia United Bank, Chinatrust, Citibank, Philippine National Bank, BPI-Philam Life Assurance Corp. and Asiatrust in which Revilla, his family and their companies hold 81 accounts.

Deposit and withdrawal analysis

Deposit and withdrawal analysis requires looking into the deposits and withdrawals as shown in bank records such as statements of account, checks, deposit slips and withdrawal slips to reveal patterns of financial activity, according to the AMLC.

Investigators confirmed that checks totaling P444.69 million issued by the National Livelihood Development Corp. (NLDC), Technology Resource Center (formerly the Technology Livelihood and Resource Center or TLRC) and the National Agribusiness Corp. (NABCOR) for Revilla’s projects indeed found their way to five Napoles NGOs:Agri and Economic Program for Farmers Foundation Inc. (AEPFFI), Agricultura Para sa Magbubukid Foundation Inc. (APMFI), Masaganang Ani Para sa Magsasaka Foundation Inc. (MAMFI), Philippine Social Development Foundation Inc. (PSDFI) and Social Development Program for Farmers Foundation Inc. (SDPFFI).

Analyzing the bank accounts of the NGOs at Land Bank, the AMLC found reason to declare that the NGOs appear to be under the control or had a relation to Napoles even if she was not an incorporator, stockholder or officer.

One proof: The bank made prior confirmations with Napoles before funds were withdrawn from the bank accounts of SPDFFI and MAMFI, it said.

“JLN’s name did not appear in the incorporation documents of SDPFFI either as an incorporator, stockholder or officer of the said NGO, yet her consent on the withdrawals was secured. As a matter of course, withdrawals are confirmed only with the account holder,” the AMLC report said. The same held true for MAMFI.

Investigators also discovered three other patterns common to all five NGOs:

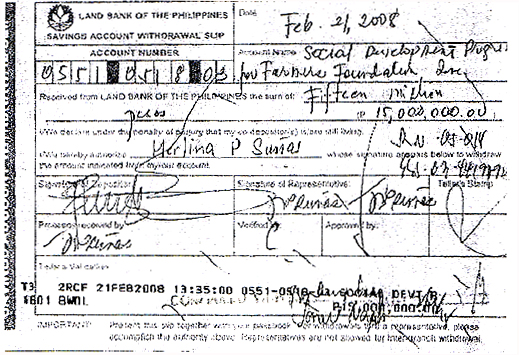

- Napoles representatives withdrew from the accounts of NGOs where they were not even listed as incorporators, stockholders or officers. They included Luy, Marina Sula, Merlina Suñas, Evelyn De Leon, John Raymond de Asis, Rodrigo Galay, Eulogio Rodriguez. The withdrawal slips show the representatives presented IDs issued by JLN Corp., in effect linking the NGOs to Napoles.

- Withdrawals took place right after deposits were made, and account balances remained minimal. This led the AMLC to describe the NGOs’ bank accounts as “temporary repositories” of funds. From 45 percent to 84 percent of the check deposits made to various bank accounts were withdrawn on the same day despite the three-day clearing period, it noted.

- Large sums were withdrawn in cash, contrary to ordinary business practice. APFMI withdrawals, for example, reached as much as P35 million even if it was capitalized at P1 million.

Tracing of funds

The AMLC used the tracing of funds or verification method to look into the commissions and rebates Revilla supposedly got from Napoles.

The method “entails comparing two information in order to determine the correctness of the information,” AMLC’s Santos said.

The AMLC said the information in the document “JLN CASH/CHECK DISBURSEMENT” (JCCD), which is similar to the entries in Luy’s ledger, matches the withdrawals reflected in bank documents.

As finance officer, Luy kept accounting records, including ledgers, of Napoles’ NGOs and foundations.

He and his fellow whistleblowers had also attached to their sworn statement matrices of cash rebates amount to P224.5 million purportedly received by Revilla by way of cash delivery through Cambe from April 6, 2006 to April 28, 2010. He also listed the sources of the money.

“After utilizing the tracing of funds method, it was established that the withdrawals as stated in the financial records matched the amounts, names of NGOs and dates cited in the JLN CASH/CHECK DISBURSEMENT. The information in the JCCD, in turn, is similar to the entries in the ledger prepared by Benhur Luy. Thus, this fortifies the veracity of the contents in said ledger,” the AMLC said.

Multiple account analysis

AMLC probers subjected the financial records of Revilla and his immediate family to multiple account analysis, through which they reviewed the records for patterns, identified unusual deposits and payments, examined flows among multiple accounts, and compared the records to known indicators and schemes.

With approval from the Court of Appeals, investigators accessed 61 bank accounts or investments under the name Revilla and his wife, Lani Mercado, and 20 accounts under their companies or his children.

Two Land Bank accounts were excluded from the analysis because the money came from the National Treasurer for Revilla’s operating budget as senator.

The first part of the multiple account analysis compared the cash balances in the bank accounts, as shown in the statements of account, to the cash balances Revilla declared in his statements of assets, liabilities and networth (SALN).

The ending balances of Revilla and his wife’s accounts from 2004 to 2010 were studied.

So were the transactional balances of their accounts within those years. The AMLC covered only placements, and not rollovers of the investments.

But the AMLC included an AUB account of Nature Concepts Development Realty Corp. controlled by Revilla’s wife “because it is a dummy corporation.”

The AMLC identified “disparities” between the cash and investment balances Revilla declared in his SALNs and those extracted from his financial records which, it said, serve as “indication of unexplained wealth.”

Said the AMLC report: “Revilla failed to declare in his SALN their cash and investment ownerships from various banks from 2004 to 2006. Likewise, there are disparities between the cash and investment values he declared in his 2007 to 2010 SALNs, and the values of their cash and investments culled from the SOAs of their various bank and investment accounts.”

The AMLC also detected discrepancies in Revilla’s SALNs and the balances of his and his wife’s transactions with various banks for those years.

It said: “In 2004, Revilla and his family transacted with banks in an amount totaling P49 million. By the end of 2004, as declared in his 2004 SALN, he had no cash on hand or in bank, but the following year, in 2005, he and his family had transactions with banks in an aggregate amount of P55 million.

“Once more, despite transacting in huge amounts of cash in 2005, he declared no cash on hand or in bank in his 2005 SALN. And yet again, in 2006, his bank transactions aggregated to P58.1 million. This pattern seems inconsistent with ordinary human experience.”

AMLC investigators said these “may serve as indication of concealment of unexplained wealth.”

Matching fund inflows to Revilla’s accounts to Luy’s ledger, the AMLC ascertained that Revilla and his family made numerous deposits to their bank accounts and placed investments totaling P 87.6 million within 30 days from the dates mentioned in Luy’s ledger when he, through Cambe, allegedly received commissions or rebates in cash from Napoles.

“Considering that the money transfers (from Napoles) were allegedly made in cash, the placements of these money in financial institutions could only have been made through cash deposits,” it said.

Aside from the two Land Bank accounts that held his operating budget as senator, the AMLC excluded from this analysis two Metrobank accounts it said were from legitimate sources, specifically Revilla’s salaries from GMA Network and fees from product endorsements.

The AMLC report singled out Lani Mercado’s company, Nature Concepts, which it said was under-capitlized and was not operating when it recorded deposits to its AUB account totaling P27.7 million from 2007 to 2010. Most of the deposits were at around the time Cambe received cash from Luy.

Revilla and his wife also transferred a total of P6 million from their Metrobank account to Nature Concepts during that period.

Nature Concepts, originally incorporated as Lady Tiger Realty Inc., registered its address at 305 Aguinaldo Hi-Way, Bacoor, Cavite, the same address as Revilla.

In 2013, immediately before and after the PDAF scandal rocked the country, Revilla terminated a number of his investments and closed several bank accounts, mostly in Metrobank and PSBank.

“Considering all the foregoing, there are indications of money laundering scheme using the aforementioned bank accounts. There is, however, a need to conduct further investigation to determine the extent of the subjects’ participation and identify the other monetary instruments that were possibly involved in the laundering scheme,” the AMLC said.