Merry Christmas! Wishing you all a spam- and scam-free Yuletide season.

The proliferation of text scams during the Christmas season proves warnings that the mandatory registration of subscriber identity module (SIM) cards is an ineffective way to curb crimes.

The SIM Registration Act, or Republic Act 11934, requires mobile device users to register their SIM cards, whether prepaid or postpaid. It was the first bill passed by Congress that President Ferdinand Marcos Jr. signed into law on Oct. 10, 2022.

It was supposed to be fully implemented starting in August after the extended deadline for the compulsory registration of SIM cards ended on July 25.

The law may be well-intentioned: to promote responsibility in the use of SIM and provide law enforcement agencies the tools to resolve crimes that involve its utilization and a platform to deter the commission of wrongdoings.

However, have the implementing agencies — the National Telecommunications Commission (NTC), Department of Information and Communications Technology (DICT), Department of Trade and Industry (DTI), National Privacy Commission (NPC), and telecommunications companies — been doing their part in implementing the law and achieve its objectives of protecting subscribers from SIM frauds and scams?

Legislators who pushed the mandatory SIM registration made us believe that this would deter the proliferation of SIM cards and internet- or electronic communication-aided crimes.

Last September, the NTC said it had received more than 45,000 complaints of text scams despite the implementation of the SIM card registration. The number could have more than doubled since then, as scammers started full-blast operations again a few weeks before the advent of the Christmas season.

Just in the past 24 hours, seven out of the 10 messages I received in my Smart subscription were scams; one was spam, and two were legitimate. In my Globe account, five were spam, three were scams, and two were legitimate.

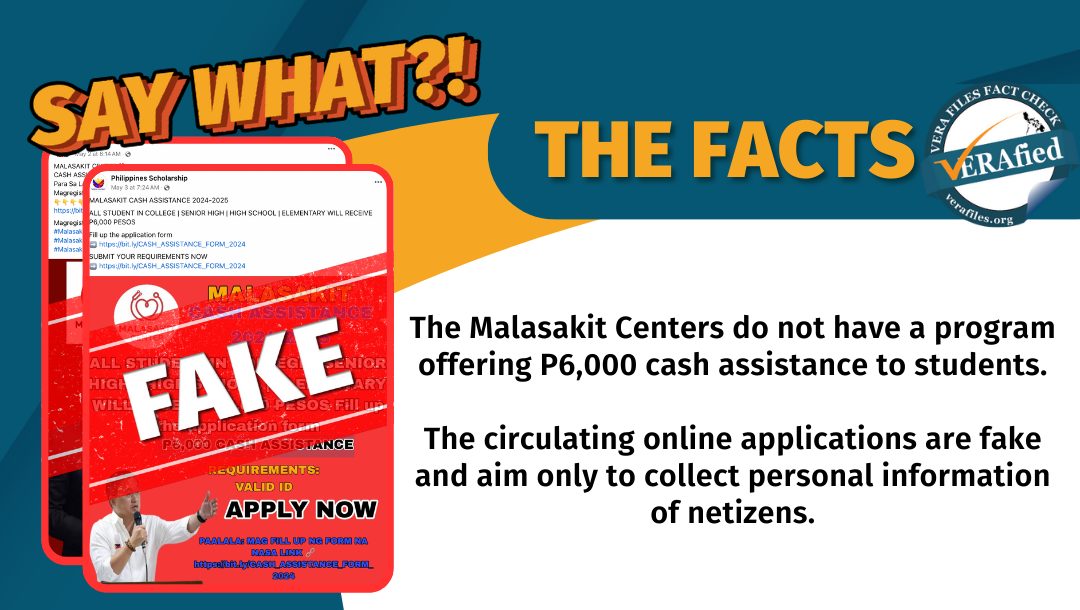

Scammers are everywhere. More are on the internet, and some are in shopping malls, victimizing unsuspecting shoppers with purported gifts or tempting sale offers but ending up with outrageously overpriced products.

Earlier this month, Alexander Ramos, executive director of the DICT’s Cybercrime Investigation Coordinating Center, said in a media forum that Filipinos lose approximately P1 billion to online scammers every year. That’s a lot of money that went into the hands of unscrupulous people.

In July, the Philippine National Police (PNP) reported a 152% increase in cybercrimes in the first six months of 2023, from 570 cases in 2022 to 1,063 from January to June this year.

By early September, PNP chief Gen. Benjamin Acorda Jr. observed a “worrisome trend” in the prevalence of cybercrimes in the country, citing that the PNP-Anti-Cybercrime Group had investigated 16,297 cybercrime cases in the first eight months of 2023.

The PNP said the top 10 cybercrimes reported to the ACG are online scams, illegal access, computer-related identity theft, automated teller machine/credit card fraud, cyber threats, data interference, photo and video voyeurism, computer-related fraud, and unjust vexation. This surge in cybercrimes is attributed to the increased reliance on the internet for various commercial activities.

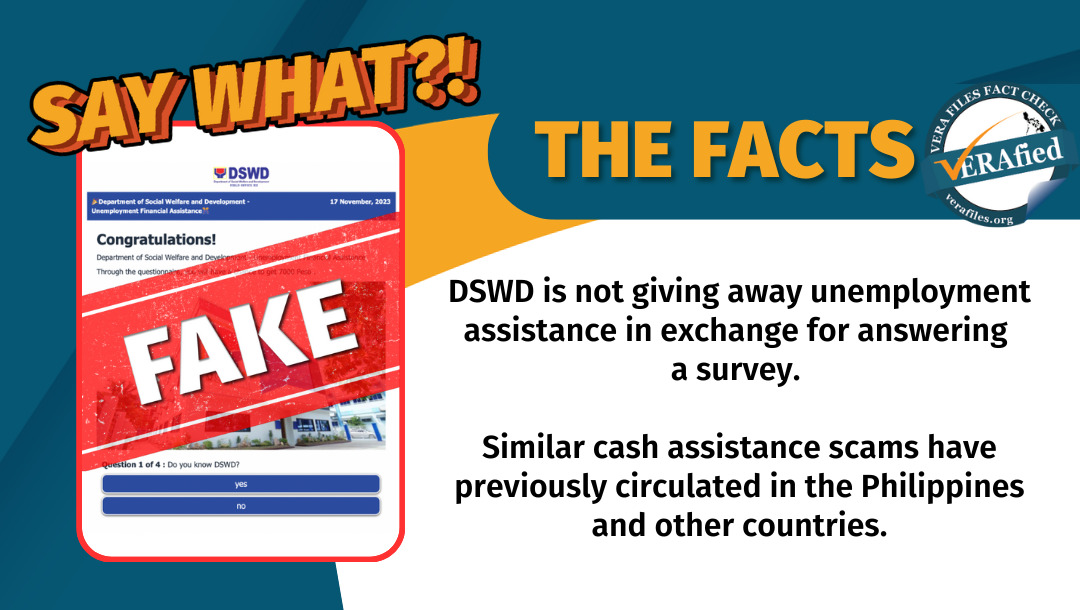

Early this month, the Cybercrime Investigation and Coordinating Center (CICC) and advocacy group Scam Watch Pilipinas identified the “12 Scams of Christmas:” fake shipping and delivery notifications, fake online charity scams, fake shopping websites, fake online sellers, free trial scams, fake Christmas gift card scams, tech support scams, crypto investment scams, fake relative/friend scams, dating scams, foreign exchange investment scams, and loan scams.

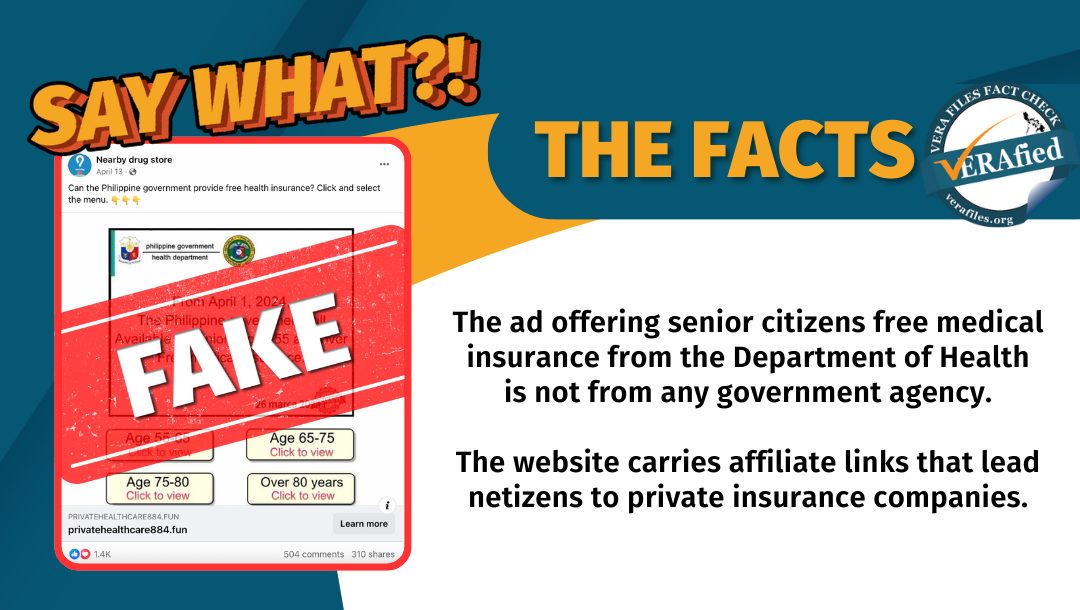

Scams and spam are both unwanted intrusions into our privacy. While spam — commonly used for unsolicited sales and marketing emails that clog up our mailbox — may be less harmful, these are also used by scammers to trick and deceive us into handing over our personal and financial information and get our money for causes, goods, or services that don’t exist.

Just this past week, how many text messages have you received about package deliveries that could not be completed “due to wrong street address” or “incomplete details” and asking you to click a link “to amend to correct address” or “confirm address details”?

How many spam messages are in your email inbox, spam folders and social media accounts?

Sen. Mary Grace Poe, who authored and sponsored the SIM registration bill, has deplored the poor implementation of the law as she urged law enforcement agencies to beef up efforts in going after scammers.

Despite the 2012 cybercrime prevention and the 2022 SIM registration laws, there’s nothing really stopping scammers from still inundating our emails, phones and social media accounts with scams and spam.

It’s easy to say “Don’t click links. Don’t fall for it.” Many times, the spam and scams look legitimate. Scammers and fraudsters have upped their creativity and manipulative skills to trick unsuspecting victims. They have become more sophisticated in their attempts to gain access to our personal information and financial accounts.

While educating the public about the various types of fraud and scams is a good prevention tool, law enforcement agencies also need to get tougher in going after these criminals, and regulatory agencies must be hard on the telcos who fail to protect subscribers’ privacy from spam and scams.

The views in this column are those of the author and do not necessarily reflect the views of VERA Files.

This column also appeared in The Manila Times.