Rebutting Palace Spokesperson Harry Roque’s statement that Congress has yet to pass a law exempting athletes from paying taxes on their winnings, Senate Minority Leader Franklin “Frank” Drilon was mistaken in noting that Republic Act No. 10699, enacted in 2015 during the term of the late President Benigno Aquino III, already provided a tax exemption for winnings in national and international sports competitions.

STATEMENT

In a July 30 press release, Drilon said:

“The Congress, through RA 10699 which was passed during the Aquino administration, already exempted all prizes and awards granted to athletes from the payment of income tax. It is erroneous interpretations such as Roque’s that create the confusion.”

Source: Senate of the Philippines, [Press Release] Drilon corrects Duterte mouthpiece: No need for Congress to pass a law to exempt Hidilyn Diaz’s Olympic winnings from income tax, July 30, 2021

FACT

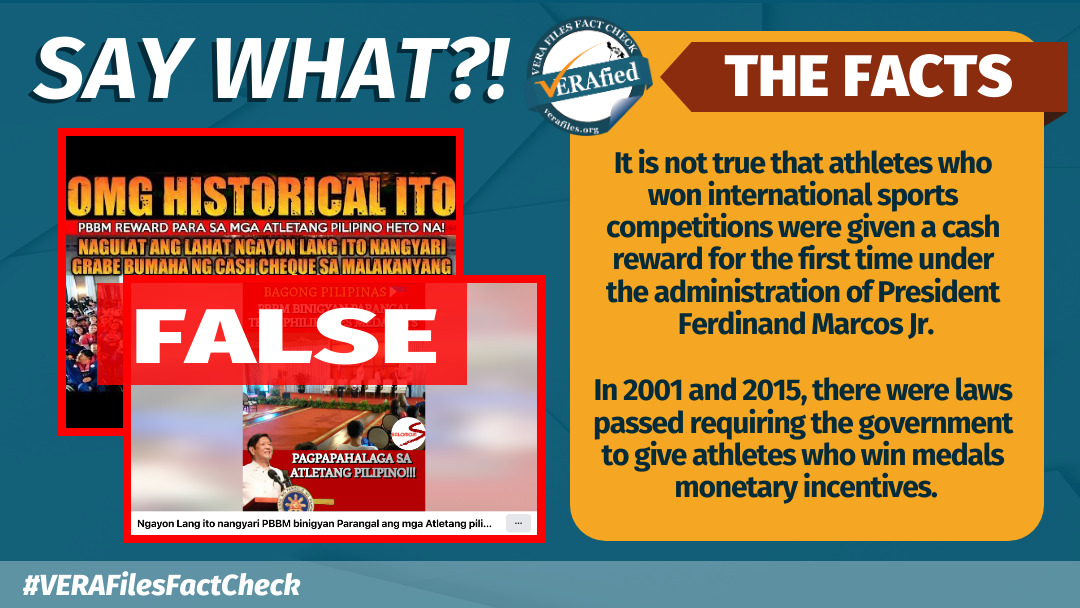

It is Republic Act No. 7549, enacted on May 22, 1992 during the term of the late President Corazon C. Aquino, that exempts from income tax payments “all prizes and awards” granted to athletes participating in local or international competitions. The same exemption applies to prize donors who are otherwise obliged to pay donor’s tax.

RA 10699, known as the National Athletes and Coaches Benefits and Incentives Act of 2015, indeed became law during the term of Aquino III. This law simply increased the cash prizes that the government would award to national athletes clinching gold, silver, or bronze medals.

Signed into law on Nov. 13, 2015, it granted a range of privileges, discounts, and benefits to athletes and coaches, whether active or retired.

The 2015 legislation repealed RA 9064, a law of the same nature enacted in 2001 under the term of then-President Gloria Macapagal-Arroyo, that awarded sports medalists with only P10,000 to P5 million pesos.