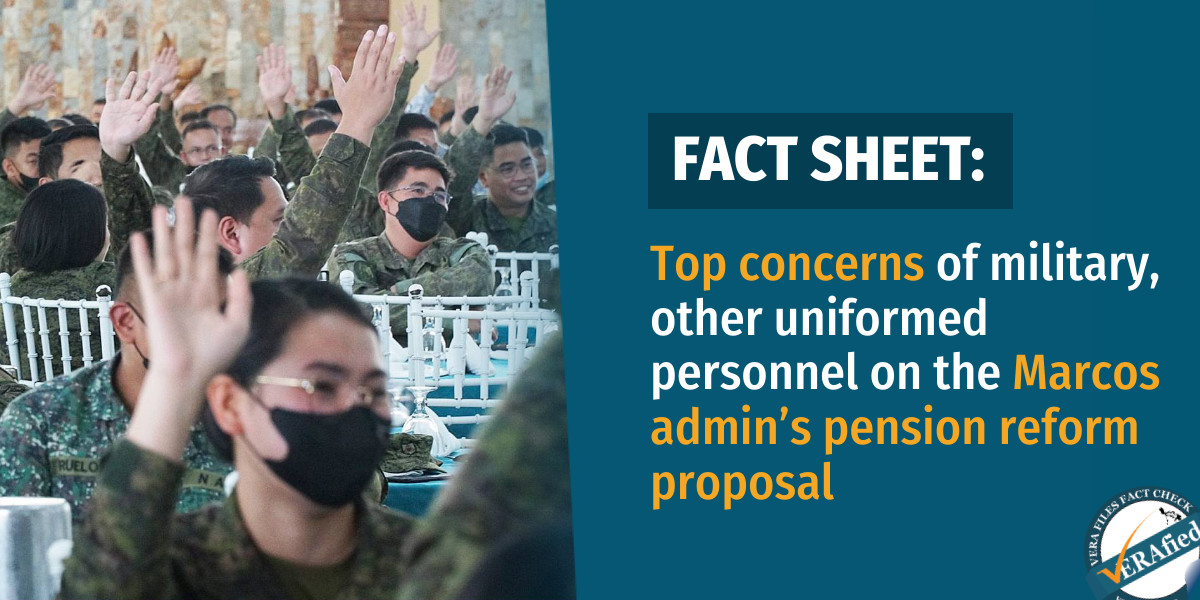

A number of active-duty officers of the Armed Forces of the Philippines (AFP) and other uniformed services are not in favor of the mandatory contributions to their pension system. This was part of the proposed reforms in the military and uniformed personnel (MUP) pension system to prevent a “fiscal collapse” in a few years.

Unlike civilian government workers and private employees, whose contributions to the Government Service Insurance System (GSIS) and the Social Security System, respectively, are deducted from their monthly take-home pay, soldiers and other uniformed personnel do not have a deduction in their monthly pay for their pension. The government allocates an amount in the annual budget for the pension of retirees in the AFP and other uniformed services.

Finance Secretary Benjamin Diokno said the annual fund for the MUP pensioners is estimated to reach P1 trillion by 2035, from around P213 billion this year.

Diokno said the non-contributory scheme for the military began in the final months of the Ramos administration following the collapse of the AFP Retirement and Separations Benefits System (RSBS) due to corruption and financial mismanagement, and exacerbated by the 1997 Asian financial crisis.

From May 25 to June 30, key officials of the Department of Finance (DOF), Bureau of Treasury (BTr) and the GSIS conducted 17 consultative meetings with the AFP, Philippine National Police (PNP), Bureau of Corrections (BuCor) and other uniformed service commands on the contentious provision of mandating pension contributions by active-duty personnel and new entrants in the uniformed service.

Then-Defense officer-in-charge Carlito Galvez and the PNP warned during a May 15 Senate hearing of a potential increase in applications for optional retirement if they will be forced to contribute a part of their salary to the pension fund.

What are the concerns raised by the military, police and other uniformed personnel on the government’s proposal to reform their pension system? Here are six issues you need to know:

1. Who will be covered by the pension reforms?

During the May 15 hearing of the Senate Committee on National Defense and Security, Peace, Unification and Reconciliation, representatives of a majority of the uniformed service agencies — the AFP, PNP, Bureau of Fire Protection (BFP), Philippine Veterans Affairs Office, Bureau of Jail Management and Penology (BJMP), Philippine Coast Guard (PCG) and the National Mapping and Resource Information Institute — agreed to require only new entrants to contribute to the pension fund.

However, the latest proposal of the economic team provides that the reform on mandatory contribution and removal of indexation should apply to both new entrants and active-duty officers. New entrants will contribute 9% of their base and longevity pay upon entering the service and the government will supplement an additional 12% to fulfill the proposed 21% total monthly premium.

Active-duty officers will contribute 5% of their salary in the first three years of the implementation of the proposed reform and the government will shoulder the remaining 16%. This sharing scheme will be adjusted until a ratio of 9% (active-duty officers) and 12% (government) is reached in the seventh year.

Based on available data, there are 134,735 military pensioners and 75,244 police pensioners.

2. What are the choices for optional retirement?

During the series of consultations, the DOF said some members of the PCG and BJMP inquired about proposed packages for optional retirement. Personnel of the PNP, BuCor, BFP and BJMP, among others, may opt to retire upon actively serving 20 years in the service, while those with PCG and AFP may retire early after 30 years of active service.

The compulsory retirement for the PNP, BuCor, BFP, BJMP and PCG is 56 years old. The mandatory retirement for AFP enlisted personnel had been raised from 56 to 57 years old last May.

The Marcos administration proposes three choices to avail of optional retirement, which will be applied on a case-by-case basis:

- Option 1: Receive all pension benefits in one lump sum upon retirement based on net present value of pension benefits.

- Option 2: 60 months advance payment of benefits based on net present value; payment of monthly pension benefits will begin after five years.

- Option 3: Receive pension benefits starting at age 57.

Responding to a question from a BJMP employee during the June 13 consultation, Finance Undersecretary Maria Luwalhati C. Dorotan Tiuseco said survivorship benefits will apply for options 2 and 3 since these are not paid in lump sum.

Survivorship benefit or pension is given to the spouse and children below 18 years old, except if unable to support themselves due to mental or physical incapacity, of a uniformed personnel who died in line of duty.

Niño Rabaya, director of the Retirement and Benefits Administration Service, said 65% of the 18,000 PNP personnel who retired from 2018 to 2022 have availed themselves of optional retirement.

In the AFP, Galvez noted that around 900 personnel have applied for optional retirement from January to March 2023. He suggested raising the minimum required years for optional retirement to 25 years or 30 years in active duty. Otherwise, around 70% of qualified military officers might retire early in 2023 or the following year, pending the passage of the reforms.

3. Will there be a salary adjustment as a consequence of the pension reform?

Tiuseco said the government can “possibly provide an additional budget for more benefits for those in active service,” adding that the pension reform is intended to create fiscal space or available funds for other government programs.

In a position paper published last April, the Philippine Military Academy (PMA) Class of 1971, which includes former senator Panfilo Lacson, called for an increase in the base pay of the military and uniformed personnel from 2024 to 2027. Their last pay raise was in 2018 and 2019 under the Duterte administration.

Diokno said any increase in the salary of active-duty officers would mean an additional amount for the pension of retirees. Currently, the pension of retirees is automatically adjusted whenever the salary for the rank from which they retired increases — a scheme called indexation.

The Marcos administration suggests an annual review of pension rates instead of indexation.

4. Who will collect and handle the pension contributions?

According to the DOF, the GSIS will manage and invest the collected monthly premiums “to achieve the required return of 85% to 90% of pension upon retirement.”

There will be an oversight committee that will determine where to invest the pension fund. It will be composed of representatives from the military and uniformed services, the secretaries of Finance and Budget and the executive secretary. The president and general manager of the GSIS will serve as an ex-officio member.

The DOF said the economic team will continue the consultations on the management of the pension funds after some BJMP personnel expressed reservations on the role of the GSIS. Defense Secretary Gilbert Teodoro Jr., who took over the DND from Galvez on June 5, likewise told the team during their June 19 meeting about “the need for expert fund managers with good track records.”

The military previously had its own pension fund, which required soldiers to contribute 5% of their monthly pay. It was managed by the AFP RSBS established in 1973 by the late dictator Ferdinand Marcos Sr. The RSBS was deactivated in 2006 due to bankruptcy for mismanagement and alleged corruption.

5. Will the GSIS mix the contributions to the MUP with the pension of civilian government workers?

GSIS Senior Vice President George Ongkeko assured the officers of the PNP and the Philippine Navy, who raised the issue in separate consultations, that there will be no “commingling” of funds with other uniformed service branches.

Deputy Treasurer Erwin Sta. Ana said the economic team wants a separate accounting for every agency and that “there will be an accounting standard that will be employed just to make sure that there is proper recording of all these funds,” making sure that it will be “strictly independent” from the GSIS pension fund for civilian government workers.

6. Why is the Marcos administration pushing for reforms only in the pension system of the military and uniformed personnel?

The PMA Class of 1971 questioned Diokno for singling out the pension system of the military and uniformed personnel when retired members of the judiciary, the prosecution service and the constitutional commissions have the highest pensions, with some exceeding P200,000 per month.

Diokno, who has been pushing for pension reforms as early as 2013, said the average monthly pension in the military is at P40,000, which is three times higher than the P13,600 average pension of civilian government workers. It is also nine times higher than the average pension of P4,528 of private employees under the SSS.

During consultations with the Philippine Army and the PCG, Finance Undersecretary Maria Cielo Magno assured that the Marcos administration will review the pension systems of other government branches enjoying similar benefits.

The PMA Class of 1971 told the economic team to first complete a full actuarial study, saying the P9.6 trillion estimate by the GSIS in 2019 to fully fund the pension system is “misleading.” It said the analysis failed to include data on the overall assets of the AFP and other uniformed services.

On July 7, the DOF said an actuarial study on the MUP pension system by the GSIS will soon be released, adding it “will serve as the basis for crafting a proposal that is data-dependent and consistent with present market conditions.”

As the government finetunes its proposal, the PMA Class of 1971 suggested adding a provision that ensures the pensions of retirees are indexed to account for inflation, and equalizing the disability pension and the maximum pension at 90% of base pay and longevity pay.