In his fourth State of the Nation Address, President Rodrigo Duterte wrongly claimed that the Land Bank of the Philippines (LANDBANK) is the biggest commercial bank in the country and that is has no programs that finance the agriculture sector.

STATEMENT

Speaking before members of Congress, Duterte talked about how he has yet to implement programs to develop the coconut industry — a campaign promise — because he has still not found an “honest man” to manage the coco levy funds estimated to be worth about P100 billion.

He then questioned LANDBANK’s performance in helping improve the agriculture sector:

“You know, you are called LANDBANK but you are now the number one commercial bank in the Philippines. What the heck is happening to you? You are supposed to finance agricultural enterprises and endeavors. Bakit wala (Why is there none)? Bakit (Why) — why can’t you just buy a few wagons or whatever? Go to the countryside and ask the people if there are cooperatives, tulungan ninyo (help them) to form one.”

He added:

“LANDBANK should go back to land. Why are you mired in so many commercial transactions? Bumalik kayo (Go back to) where you were created for and that is to help the farmers.”

Source: Source: PCOO, 4th State of the Nation Address of President Rodrigo Roa Duterte, July 22, 2019, watch from 1:26:24 to 1:27:48

Duterte then ordered the bank to come up with a “viable plan” to help farmers and submit it to his office by the end of July:

“I am asking now Congress, pag wala sila (if they do not have), if there is no viable plan for that, for the farmers, and it is just all commercial transactions, might as well abolish it and give the money to the congressmen for their development funds.”

Source: PCOO, 4th State of the Nation Address of President Rodrigo Roa Duterte, July 22, 2019, watch from 1:28:07 to 1:28:25

FACT

Duterte got two things wrong.

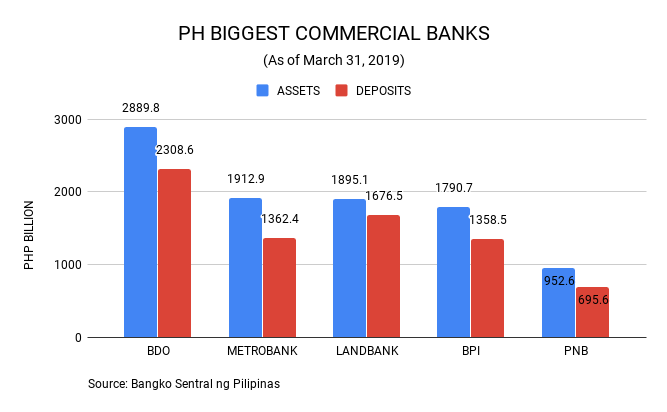

First, LANDBANK is not the biggest commercial bank in the country.

It is the third biggest bank in terms of assets with P1.895 trillion and second in terms of deposits with P1.68 trillion as of March 31, according to the Bangko Sentral ng Pilipinas.

Here are the country’s biggest banks and their rankings in terms of assets:

- BDO Unibank (BDO) – P2.89 trillion

- Metropolitan Bank & Trust Company (Metrobank) – P1.91 trillion

- LANDBANK – P1.895 trillion

- Bank of the Philippine Islands (BPI) – P1.79 trillion

- Philippine National Bank (PNB) – P95 billion

BDO is also the country’s largest bank in terms of deposits with P2.31 trillion, followed by LANDBANK, Metrobank (P1.36 trillion), BPI (P1.358 trillion) and PNB (P69 billion).

Second, it is not true that LANDBANK is not financing agriculture enterprises and endeavors, and that it is focused only on commercial transactions.

According to LANDBANK, it is:

“A government financial institution that strikes a balance in fulfilling its social mandate of promoting countryside development while remaining financially viable.

The profits derived from its commercial banking operations are used to finance [its] developmental programs and initiatives.”

Source: Landbank of the Philippines, About Us

In a press statement sent to VERA Files, LANDBANK said 93 percent of its P799.64-billion loan portfolio was allocated to the agriculture sector and development programs of the government.

The bank said its loans to the sector accounted for 22.17 percent of its total loans. As of end-June, LANDBANK has released P177.32 billion including:

- P119.52 billion for agribusinesses;

- P2.59 billion for aqua-businesses; and

- P55.21 billion for agri-aqua related projects of local government units and government-owned and -controlled corporations.

LANDBANK has also released P42.31 billion in loans to its “mandated” sectors: P42.17 billion to small farmers, including agrarian reform beneficiaries (ARB), and P135 million to small fishers and their associations.

In its 2017 Annual Report, its latest available, the bank enumerated its agricultural credit and support programs geared towards helping local farmers, fisherfolk, micro, small, and medium enterprises (MSME), local government units (LGU), and government-owned and -controlled corporations. These include:

- Sikat Saka Program – a credit program established with the Department of Agriculture (DA) that provides small rice and corn farmers with market support, free irrigation services, and crop insurance subsidy and training;

- Agricultural and Fisheries Financing Program or AFFP – a credit program for small farmers and fishers registered in the Registry System for Basic Sectors in Agriculture;

- Agrarian Production Credit Program or APCP – a tie-up with the DA, Department of Agrarian Reform (DAR), and the Department of Environment and Natural Resources designed as a “flexible credit facility” for ARB organizations that are not yet qualified for regular lending from LANDBANK and other formal financial institutions;

- Agricultural Credit Support Project or ACSP – provides credit and non-credit support to small farmers and fishers groups, small and medium enterprises, large agribusinesses, and financial institutions engaged in agriculture and agri-related projects;

- Agricultural Competitiveness Enhancement Fund or ACEF – a credit program for farmers and fisherfolk, their cooperatives and associations, and micro and small enterprises to increase productivity;

- Assistance to Restore and Install Sustainable Enterprises for Agrarian Reform Beneficiaries and Small Farms Holders or ARISE-ARB – offers financial support for disaster-affected ARBs, small farm holders, and their families to restore livelihood and farming activities;

- Masustansyang Inumin Para sa Likas na Kalusugan or MILK – established with the National Dairy Authority to support the financing requirements of qualified small farmers, cooperatives, federations, and small and medium enterprises for dairy production, processing, and marketing; and

- Credit Assistance for Cacao Agribusiness Entities and Other Organizations 100 or CACAO 100 – a program aimed at financing cacao industry stakeholders to help reach their goal of producing 100,000 metric tons of dried fermented beans by 2022.

Duterte even recognized these efforts in his message to LANDBANK, which was included in the same annual report:

“Over the past year, LANDBANK’s relentless efforts in coming up with new, innovative and responsive lending programs and interventions have facilitated the development of communities and improved service accessibility, especially for hard-to-reach sectors and those located in the countryside.

Its activities have not only allowed it to maintain its standing as one of the country’s largest financial institutions but, more importantly, enabled it to fulfill its mandate to serve its priority sectors.”

In a press statement, Finance Secretary and LANDBANK Chairman Carlos Dominguez III defended the state-run financial institution:

“…LANDBANK is also working closely with [DAR] in speeding up the distribution of individual land titles to agrarian reform beneficiaries as a means to improve the bankability of small farmers.

“Moreover, the LANDBANK also performs other critical functions such as distributing cash grants to the Pantawid Pamilyang Pilipino Program (4Ps) households and the Pantawid Pasada fuel subsidy beneficiaries.”

Source: Department of Finance, Press Release: Dominguez urges Congress to pass remaining CTRP bills, higher excise taxes on alcohol, e-cigarettes before yearend, July 23, 2019

On July 30, LANDBANK told VERA Files that it has already submitted a report “detailing its plans and programs to further achieve its objective” to the president, through the Department of Finance.

Sources

Presidential Communications Operations Office, 4th State of the Nation Address of President Rodrigo Roa Duterte, July 22, 2019

Bangko Sentral ng Pilipinas, Universal and Commercial Bank Group Ranking as to Total Assets as of March 31, 2019

Bangko Sentral ng Pilipinas, Universal and Commercial Bank Group Ranking as to Total Deposit Liabilities as of March 31, 2019

LANDBANK, About Us

LANDBANK, 2017 Annual Report: Expanding Financial Inclusion in the Countryside

LANDBANK, 93% of LANDBANK’s loan portfolio supports agriculture sector and government development programs, July 30, 2019

Landbank.com, LANDBANK Loans to Farmers

Department of Finance, Press Release: Dominguez urges Congress to pass remaining CTRP bills, higher excise taxes on alcohol, e-cigarettes before yearend, July 23, 2019

(Guided by the code of principles of the International Fact-Checking Network at Poynter, VERA Files tracks the false claims, flip-flops, misleading statements of public officials and figures, and debunks them with factual evidence. Find out more about this initiative and our methodology.)