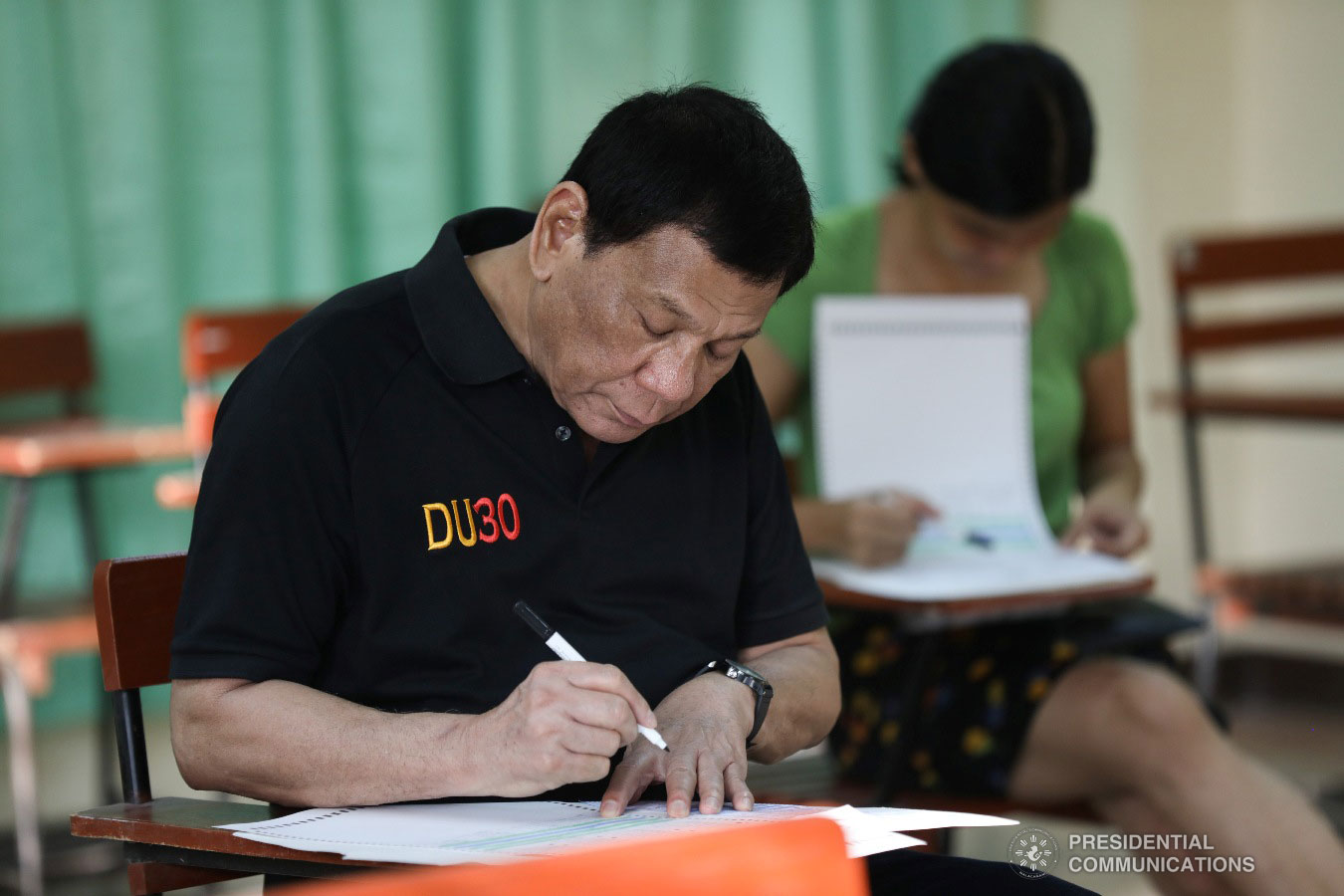

The Philippine economy has been through ups and downs in the first three years of President Rodrigo Duterte’s administration.

On the macroeconomic front, the country’s growth, measured by the gross domestic product (GDP), slowed down to a four-year-low 5.6 percent in the first quarter.

Economic managers blame the decline to the budget deadlock in Congress, which caused the delay in the passage of the 2019 national budget.

The budget impasse forced the government to operate on a reenacted budget for the first three months of the year. This also prompted economic managers to revise downward its GDP target to 6 to 7 percent for 2019. But, they maintained their 7 to 8 percent growth target for next year until the end of Duterte’s term in 2022.

However, economists interviewed by VERA Files argued that while the 5.6 percent GDP in the first quarter is “respectable,” the 7 to 8 percent target is “too ambitious,” and is therefore “unattainable.”

Action for Economic Reforms researcher AJ Montesa said, he does not see the local economy hitting at least 7 percent over the short to medium terms.

“A lot of things have to go right to hit that 7 percent or 8 percent growth, and I just don’t see that happening right now with a lot of instability, especially now that there’s a new set of legislators coming in so you have to sort of reset expectations,” Montesa said.

Meanwhile, UnionBank Chief Economist Carlo Asuncion said, the economy might have a chance to hit the lower band of the target, if the government would be able to spend the nearly P9 trillion budget allocated for the “Build, Build, Build” infrastructure program.

But based on the government’s roadmap, majority of the infrastructure projects will go online beyond 2022.

Nonetheless, Montesa and Asuncion emphasized that it is crucial for the government to push through with key reforms to sustain the local economy’s growth momentum. (See SONA 2018 Promise Tracker: Economy)

Comprehensive Tax Reform Program

One of them is the Comprehensive Tax Reform Program (CTRP), which seeks to update some provisions and correct deficiencies in the country’s tax system, making it “simpler, fairer, and more efficient.”

In 2017, Duterte passed the first package of the CTRP, or the Tax Reform for Acceleration and Inclusion (TRAIN) law. The measure, which took effect in January last year, reduced personal income taxes but increased duties on vehicles, fuel, tobacco, and sugar-sweetened beverages.

It received flak months after its implementation for contributing to the increase in consumer prices, which surged to a nine-year-high 6.7% in September last year.

Meanwhile, CTRP’s Package 2, also known as Tax Reform for Attracting Better and High-quality Opportunities (TRABAHO) bill, did not reach the President’s table for signature as anticipated, because it was not ratified in the 17th Congress.

Investors welcome the provision in the TRABAHO bill that would slash corporate income taxes from 30 percent by two percentage points every two years starting 2021 until it reaches 20 percent in 2029. But, they are concerned with the proposal modernizing incentives given to businesses.

The rest of the packages, which include increasing taxes on alcohol and government’s share on miners’ revenues (Package 2 Plus), centralizing property valuation and assessment (Package 3), and simplifying taxation of passive income and financial instruments (Package 4), have yet to be tackled in the 18th Congress.

“Build, Build, Build” infrastructure program

Economic managers are banking on TRAIN revenues to help finance its nearly P9 trillion infrastructure program, cementing what they tout as “The Golden Age of Infrastructure.”

There are 75 flagship projects under the “Build, Build, Build” program, which include construction and rehabilitation of roads, railways, airports, and irrigation systems among others. The National Economic and Development Authority Board, chaired by the President himself, has already approved 37 of these projects so far (See SONA 2018 Promise Tracker: Infrastructure).

According to a NEDA report, 25 big-ticket projects are expected to be completed by 2022, while the other 50 will be accomplished beyond Duterte’s term.

The government’s infrastructure program has been subject to scrutiny because majority of its projects will be financed by official development assistance or ODA from bilateral partners and multilateral lenders.

One of the most controversial projects is the construction of the P12.5 billion Kaliwa Dam in Quezon that will be funded by ODA from China. Early this year, the Makabayan bloc, alongside advocacy groups, filed a petition before the Supreme Court to declare the country’s loan agreement with China as “illegal” and “void” due to numerous provisions that are allegedly unconstitutional, including its confidentiality clause.

Critics warn that the Philippines might fall into a debt trap with China due to its onerous loan agreements with the Asian giant, which include the funding of the Chico River Pump Irrigation Project.

Supreme Court Associate Justice Carpio earlier warned Beijing could seize natural gas deposits in Reed Bank if Manila is unable to pay its loan for the construction of the Chico River Pump Irrigation, and that the same could also happen for the Kaliwa Dam.

According to Bangko Sentral ng Pilipinas Deputy Governor Diwa Guinigundo, the Philippines has about $980 million in loans from China as of the end of 2018.

However, economic managers brushed off these concerns, saying, the country has never defaulted on any loan agreement and that it is in a good fiscal position.

The country’s external debt reached P7.29 trillion by the end of 2018. As of May, it hit a record-high P7.92 trillion.

Ease of Doing Business Act

Last year, Duterte signed Republic Act (RA) 11302 or the Ease of Doing Business Act, which amends the Anti-Red Tape Act of 2007.

The law seeks to improve the country’s business climate and attract more local and foreign investors, by providing a two-strike policy holding government employees and officials administratively and criminally liable for committing violations. Key officials finally ratified the law’s implementing rules and regulations on July 17.

According to the World Bank’s 2019 Doing Business report, the Philippines placed 124th out of 190 economies — 11 notches lower than its rank last year — due to high business registration costs and difficulties in getting credit, among others.

Rice Tariffication

The President signed RA 11203 or the Rice Liberalization Act in February, amending the Agricultural Tariffication Act of 1996. The law is a fulfillment of the country’s commitment to the World Trade Organization to replace the quantitative restrictions (QR) on rice imports with tariffs.

A QR prohibits a country from importing rice beyond a certain volume. Sine 2012, the Philippines has been importing rice only up to a maximum of 805,200 metric tons.

Economic managers expect the rice tariffication law to help secure food supply and bring down the cost of the staple food as it allows imported rice to flood the market.

Government data show that since the law took effect in March, rice prices have gone down, contributing to the decline in the inflation rate.

However, some research groups like IBON said that the measure would disadvantage local farmers and would adversely affect the local rice industry. State-funded think tank Philippine Institute for Development Studies has estimated that rice tariffication would reduce local farmers’ income by 29 percent.

“Any sort of liberalization policy would always have that kind of risk: that the local industry might suffer, especially if mas efficient ‘yung iniimport natin (what we are importing is more efficient),” Montesa said.

But in order for the rice tariffication law to not be a stopgap measure to control inflation, experts are calling on the government to ensure that long-term measures would be in place to boost the competitiveness of the local rice industry, and to be able to meet the demand for food of a growing population at affordable prices.

“It’s really important that while we have rice tariffication, while we are liberalizing our rice imports in the short-run to make the price of rice lower…the government needs to invest on those rice farmers by helping them become more advanced [and] adapt technologies that will lower their costs and make them more productive in terms of their yield,” he added.

Under the law, P10 billion from tariff collections must be allocated to the Rice Competitiveness Enhancement Fund, in order to fund mechanization, credit, seed and training programs for local farmers.

Challenges facing PH Economy

Montesa and Asuncion emphasized that the main challenges facing the local economy are the passage of key policies, proper enactment of reforms passed and their sustainability.

They also stressed that the government must ramp up efforts to address the country’s perennial problems such as low farm productivity, persistence of poverty and political instabilities that threaten economic growth.

Poor performance of the agriculture sector

Agricultural production grew by only 0.56 percent in 2018, way below the government’s 4 percent target. In the first quarter, farm output further declined to 0.67 percent from 1.80 percent in the last quarter of 2018.

The agricultural labor force has also been on a drastic decline, losing over 1.5 million workers in the past five years alone. This means lower production as more farmers and fishermen shift to other livelihoods.

“One of the things that the Philippines has missed out on is developing its industries,” Asuncion said. “In a country that is so susceptible to weather disturbances, it’s really a challenge for the government to enable the agriculture sector,” he added.

Experts have already listed several proposals to improve agricultural output, including the improvement in research and development, construction of quality infrastructure for farming and irrigation systems for higher yield, and development of climate-resilient farming technologies among others.

For Asuncion, improvement in the agriculture sector will help solve the unemployment and underemployment in the country.

Underemployment and Unemployment

While economic managers trumpet the low unemployment rate, data show that underemployment remain high.

In the fourth quarter of 2018, unemployment was at 5.1 percent while underemployment was at 13.3 percent.

The Philippine Statistics Authority defined underemployed individuals as “employed persons who express the desire to have additional hours of work in their present job or an additional job, or have a new job with longer working hours.”

Asuncion attributed the high unemployment rate to: lack of jobs, especially outside Metro Manila and key cities such as Cebu and Davao, low quality of existing jobs, insufficient pay and job-skills mismatch.

He explained that the Philippines is “at a demographic sweet spot” because its labor force is composed of a younger population.

“But how do you manage to take advantage of that, and take advantage of the demographic dividend of the Philippines? How do you go from that 6 percent (GDP) to another level para maabutan natin (so we can catch up), hopefully in 10 years even Thailand,” he said.

Poverty reduction

For Asuncion, growth will be “just numbers” if it would not be inclusive and felt by the poorest sectors.

According to the PSA, the number of Filipinos living below the poverty line declined to 21 percent in the first semester of 2018, as compared to the 27.6 percent poverty incidence rate in the first half of 2015.

Meanwhile, poverty incidence among families also fell to 16.1 percent in the first half of 2018 from the 22.2 percent recorded in the same period in 2015.

PSA reported that a family of five needs no less than P10,481 monthly on the average in order to live above the poverty line, which critics called out as “unrealistic.”

Economic managers are targeting to bring down poverty rate to 14 percent by 2022. But Montesa is not too optimistic that the goal would be met.

“It will be premised on investing in people, on giving them opportunities to find jobs, for example. Good start ‘yung (is the) investment in their health. Good start ‘yung (is the) investment in infrastructure; it will provide some jobs, it will provide opportunities for them. Good start ‘yung (is the) investment in basic education. But again, it’s very hard to say; things have to go right, everything has to go right, if we’re going to hit that 14% rate,” he said.

Political instabilities

Montesa and Asuncion said that while political noises within the administration are not strong enough to drag the local economy, they are not helping it grow, either, as they take away the government’s focus on its key reforms.

They cited the proposed shift to federalism – one of the key items on Duterte’s political agenda — as an example. In July last year, the 22-member Consultative Committee formed by the President submitted the draft Constitution of the envisioned Federal Republic of the Philippines. (See VERA FILES FACT SHEET: How the Consultative Committee pictures a ‘Federal Republic of the Philippines’)

But the President’s own economic managers are warning against the shift to federalism. Finance Secretary Carlos Dominguez III said that the Philippines’ credit ratings would “go to hell” if the shift to federalism proceeds.

“It’s not a very good sign for investors kasi (because) cha-cha is threatening to change the whole system of the government, so there’s the possibility of change of structure of governance,” Montesa said.

For his part, Asuncion said “it is already too late” for a shift to a federal government because it will “disrupt a lot” of plans, which would be “very stressful to the economy.”

Asuncion also urged the administration, rather than threatening the stability of its institutions, to “get its act together” so it can pass necessary reforms to boost growth.

Montesa also shares the same view. He said that while it is difficult to predict the local economy’s growth trajectory for the remaining half of Duterte’s term, he is optimistic it will remain strong as long as the government does not sabotage its own chances.