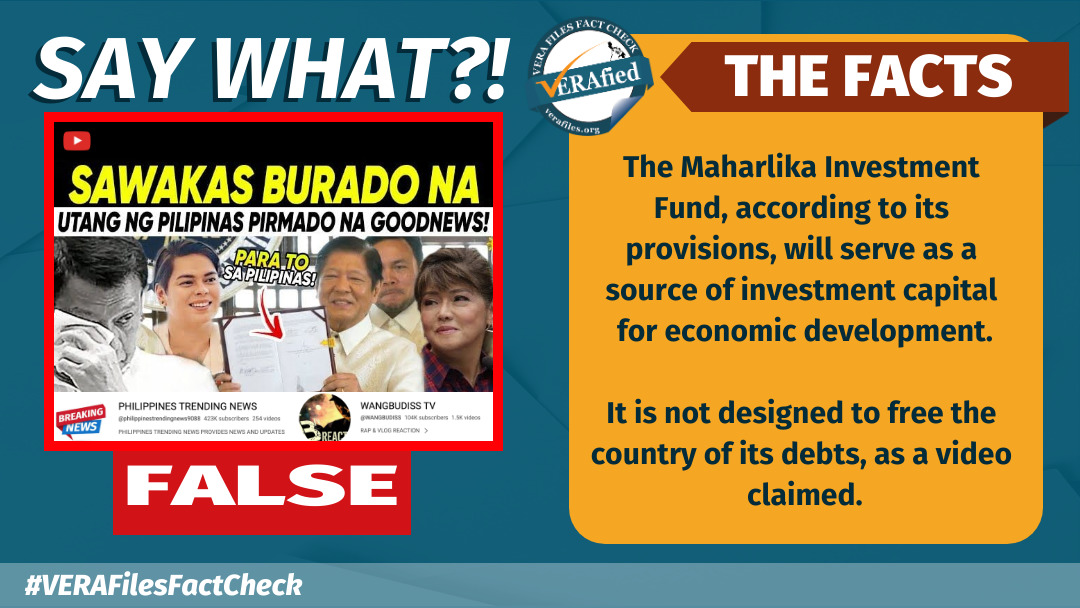

In his second State of the Nation Address in 2023, President Ferdinand “Bongbong” Marcos Jr. promised: “In pooling a small fraction of the considerable but underutilized government funds, the (Maharlika) Fund shall be used to make high-impact and profitable investments, such as the Build Better More program. The gains from the Fund shall be reinvested into the country’s economic well-being.”

More than a year and several delays later, the first project of the controversial Maharlika Investment Fund (MIF) is still pending.

Here are three things you need to know:

1. What happened?

Since his appointment as Maharlika Investment Corporation (MIC) president and chief executive officer in November 2023, Rafael Consing Jr. has discussed putting its first investment into promising sectors. The MIC is the corporate arm of the country’s first sovereign wealth fund tasked to choose and decide on its investments “to generate optimal returns.”

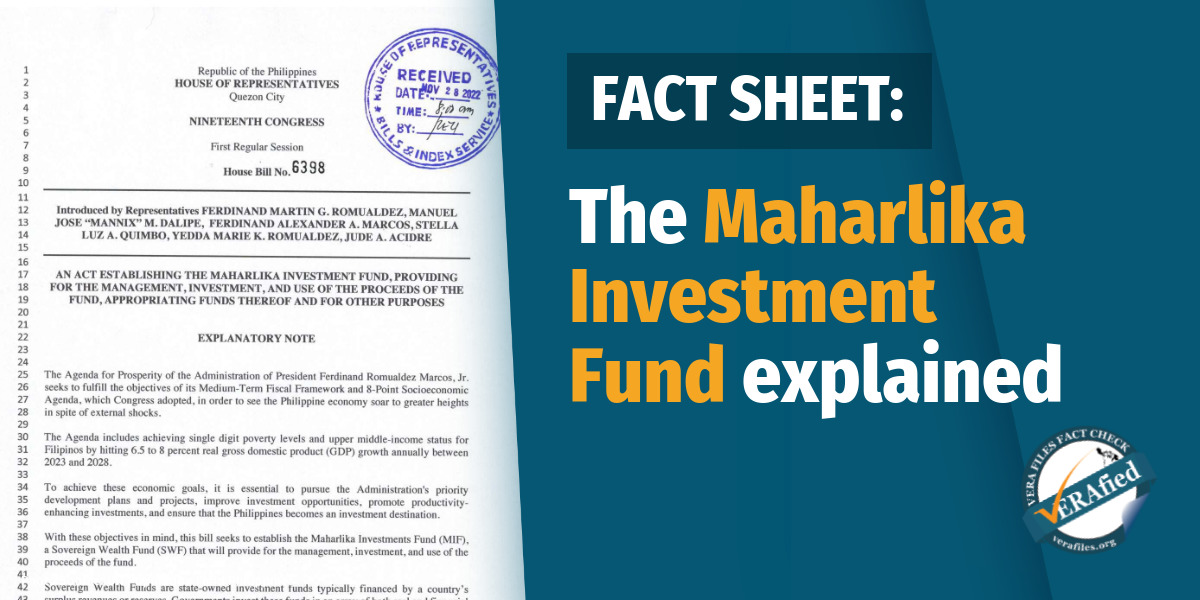

House Bill No. 6398, filed on Nov. 28, 2022, sought to create the MIF. The bill faced backlash from concerned groups due to the inclusion of GSIS and SSS as sources of funding. House Bill No. 6608, filed on Dec. 12, 2022, excluded both as funding sources; the bill breezed through the lower chamber which approved it on Dec. 15, 2022

Its counterpart Senate bill was passed five months later on May 31, 2023 after Marcos certified the proposed law as urgent.

Republic Act (R.A.) No. 11954 or the MIF Act was signed into law on July 18, 2023 and its final implementing rules and regulations (IRR) took effect four months later.

“It is a crucial undertaking. It will support our overall goal of 6.5 to 8% gross domestic product growth in the medium term. And through the fund, we will accelerate the implementation of the 194 NEDA Board-approved flagship infrastructure projects,” the president said in a speech at the signing ceremony of the MIF Act on July 18, 2023.

By September that year, the Landbank of the Philippines and Development Bank of the Philippines had remitted the P75 billion seed money to the MIC as required by the law.

On Nov. 24, 2023, Consing, former banker and executive director at the Office of the Presidential Adviser for Investments & Economic Affairs, took his oath as head of MIC. Marcos appointed four other directors the following month and the board held its inaugural meeting on Jan. 3, 2024, past the date the administration had originally committed to operationalize the sovereign fund.

In a Bloomberg interview published on Jan. 18, 2024, Consing said the corporation planned to invest in “infrastructure and energy sector” by the first half of that year to address the country’s most pressing needs. He added,

“I expect that (first investment) probably happening in the next 90 to about 120 days. In terms of the amount, well, that has to be determined by the committee just yet.”

Source: Philippine Wealth Fund Plans First Investment in Three to Four Months, Jan. 18, 2024, watch from 0:51 to 1:00

A month later on the sidelines of the Philippine Economic Outlook forum, Consing said MIC was still finalizing its organizational structure and that the first investment would instead be made at the end of 2024.

He echoed this timeline in August, saying:

“We have about eight memorandums of agreement currently taking due diligence on two very important investments. Both in the energy sector. And intuitively, we expect perhaps that in the next 60 to 90 days, we should be able to deploy (the investments).”

Source: Senate of the Philippines Youtube page, Committee on Finance (Subcommittee A) (August 27, 2024), Aug. watch from 2:02:37 to 2:03:05

As 2024 ended, Consing again pushed back the target date, saying he expected the initial project to finally happen in the first quarter of this year.

In an interview with BusinessWorld last Jan. 2, Consing admitted that organizational preparations consumed the corporation’s first year, saying:

“Definitely the first quarter (MIC will make its first investment). I think we had a year to set up. We had a year to basically put our governance in place. We obtained our formal approval to begin hiring last end of July.”

Source: BusinessWorld, Maharlika plans its 1st investment in Q1, Jan. 7, 2025

Consing said that MIC now expects its first investment to still be in the energy sector with the healthcare industry to follow within the first half of 2025.

2. How did the domino effect in MIF delays begin?

Marcos threw out the original IRR of the MIF law dated Aug. 22, 2023. In an Oct. 19, 2023 speech, he denied that this meant putting the MIF “on hold.”

“We have found more improvements that we can make, specifically to the organizational structure of the Maharlika Fund,” the president said. “The concept [of the MIF] remains a good one and we are still committed to having it operational before the end of the year [2023].”

The revised IRR was signed on Nov. 10, 2023, but Marcos replaced then finance secretary Benjamin Diokno, slowing down the structural organization of the corporation.

Section 20 of the MIF Act provides that the secretary of finance automatically assumes the position of chairperson of the MIC’s board of directors. Diokno turned over his position to current Finance secretary and MIC Chairman of the Board Ralph Recto on Jan. 15, 2024.

3. What changed in the revised IRR?

Section 30 of the revised IRR added the provision that the president can reject the advisory body’s recommendation for director positions.

It also amended Section 29 of the original IRR which specified the qualifications required of MIC directors, including a master’s degree and a 10-year experience in relevant fields. These are excluded from the revised version, which also removed the itemized responsibilities of the risk management and audit committees in Sections 41 and 42, respectively, of the original IRR.

Sections 39 and 40 of the revised version changed these into: “The specific functions of the Risk Management Committee shall be determined by the Board,” and “The Board shall organize an Audit Committee and prescribe its functions and membership.”